![What Does DSO Stand For? Explained in Simple Terms | [Website Name] What Does DSO Stand For? Explained in Simple Terms | [Website Name]](/wp-content/uploads/2023/09/what-does-dso-stand-for-explained-in-simple-terms.jpg)

DSO is an acronym that is commonly used in various fields to denote a specific term or concept. The abbreviation DSO stands for “Days Sales Outstanding”, which is a financial metric used to measure the average number of days it takes for a company to collect payment for its sales.

The term DSO signifies the calculation of the average collection period, allowing businesses to have an idea of their accounts receivable turnover and the efficiency of their cash flow management. In simple terms, it represents the time it takes for a company to convert its sales into cash.

So, what does DSO mean? The definition of DSO is the average number of days it takes for a company to collect payment from its customers. It is calculated by dividing the total accounts receivable by the average daily sales. A lower DSO usually indicates that a company has a better ability to collect payments quickly, while a higher DSO may signify delays in cash flow and potential financial problems.

In summary, DSO stands for “Days Sales Outstanding” and it represents the average number of days it takes for a company to collect payment for its sales. This abbreviation is commonly used in financial analysis and is an important metric for evaluating a company’s cash flow management and financial performance.

Contents

- 1 DSO – Meaning and Explanation

- 2 What is DSO?

- 3 DSO in Business and Finance

- 4 DSO in Technology and Computing

- 5 DSO in Other Contexts

- 6 FAQ about topic “DSO Decoded: Understanding the Meaning Behind the Acronym”

- 7 What does DSO stand for?

- 8 How is DSO calculated?

- 9 Why is DSO important for businesses?

- 10 How can a company reduce its DSO?

- 11 What are the limitations of using DSO as a metric?

DSO – Meaning and Explanation

DSO is an acronym that stands for Denomination Signifies Organization. The term DSO is commonly used in various fields and industries to represent the abbreviation dso or denote the concept or organization it signifies.

The acronym DSO is often used in financial and business contexts to represent the term Days Sales Outstanding. In this context, DSO refers to the average number of days it takes for a company to collect payment from its customers after a sale has been made. It is an important metric for measuring a company’s efficiency in managing its accounts receivable.

In addition to its financial meaning, DSO can also be used to represent other terms or concepts, depending on the context. For example, in the telecommunications industry, DSO stands for Digital Storage Oscilloscope, which is a device used for analyzing and measuring electronic signals.

Overall, the meaning of DSO can vary depending on the industry or field in which it is used. It signifies an abbreviation or acronym that represents a specific term, concept, or organization. Whatever its specific meaning, DSO is a commonly used abbreviation that can be found in various contexts.

What is DSO?

DSO is an acronym that stands for Days Sales Outstanding. This term signifies the number of days it takes for a company to collect payment on its sales. DSO is a key metric used by businesses to measure their accounts receivable performance.

The abbreviation DSO represents the average number of days it takes for a company to collect payment from its customers after a sale. It is calculated by dividing the accounts receivable balance by the average daily sales. DSO is often used by businesses to evaluate their credit and collection policies.

The definition of DSO denotes the efficiency of a company’s cash flow. A lower DSO signifies a shorter time it takes for a company to collect payment, which can be a positive indicator of financial health. On the other hand, a higher DSO may indicate that a company is having difficulty collecting payments from its customers.

DSO is a term commonly used in the finance and accounting industry. It represents the number of days it takes for a company to convert its sales into cash. By monitoring DSO, businesses can assess the effectiveness of their credit and collection processes and make informed decisions to improve cash flow.

In summary, DSO is an abbreviation that stands for Days Sales Outstanding. It is a metric used to measure the average number of days it takes for a company to collect payment on its sales. DSO signifies the efficiency of a company’s cash flow and is an important indicator for businesses to monitor and manage their accounts receivable performance.

Defining DSO

DSO stands for Days Sales Outstanding. This term represents the average number of days it takes for a company to collect payment after a sale has been made. In simple terms, DSO is a financial metric that helps businesses measure the efficiency of their accounts receivable management.

The definition of DSO is straightforward – it’s the average time it takes for a company to receive payment from its customers after a sale. DSO is usually calculated on a monthly, quarterly, or annual basis, depending on the business’s needs.

DSO is an abbreviation for Days Sales Outstanding, and it is often used to signify the company’s ability to collect payment from its customers. A low DSO indicates that a business is efficient in collecting payments, while a high DSO may indicate a potential cash flow problem.

So, what does DSO stand for? It is an important financial metric that represents the average amount of time it takes for a business to receive payment from its customers, denoting the efficiency of accounts receivable management. In simpler terms, DSO means the number of days it takes to get paid after making a sale.

DSO in Business and Finance

DSO stands for Days Sales Outstanding in business and finance. It is an acronym that denotes the average number of days it takes for a company to collect payment from its customers after a sale has been made.

In simpler terms, DSO represents the average time it takes for a company to receive payment for goods or services it has provided. It is a common financial metric used to measure the effectiveness of a company’s credit and collection policies.

The DSO calculation is based on the average accounts receivable balance and the total sales for a given period. By dividing the accounts receivable by the total sales and multiplying it by the number of days in the period, businesses can determine their DSO.

A high DSO may signify that a company is having difficulty collecting payments from its customers, which can impact its cash flow and financial health. On the other hand, a low DSO may indicate that a company has efficient credit and collection policies, allowing it to quickly receive payment for its sales.

Understanding and monitoring DSO is important for businesses as it can help them identify potential cash flow issues and make informed decisions about their credit and collection practices. By keeping their DSO in check, businesses can ensure a healthy and stable financial position.

Understanding the Importance of DSO

DSO, or Days Sales Outstanding, is a key financial metric that measures the average number of days it takes for a company to collect payment from its customers after a sale. It is often used by businesses to gauge the effectiveness of their credit and collection policies.

The DSO denominator represents the total accounts receivable, which signifies the amount of money owed by customers to the company. By tracking the DSO, businesses can identify trends, spot potential cash flow issues, and take proactive measures to shorten the payment cycle.

The DSO represents the average number of days it takes for a company to collect payments, which can denote the efficiency of the company’s credit and collection processes. A lower DSO generally signifies a more efficient process, whereas a higher DSO may indicate issues with credit terms or collection efforts.

The importance of DSO lies in its ability to provide valuable insights into a company’s financial health. It represents the effectiveness of the company’s accounts receivable management, customer payment behavior, and overall cash flow management.

In summary, DSO is an abbreviation that stands for Days Sales Outstanding and is a financial metric used to represent the average number of days it takes for a company to collect payment from its customers. It signifies the efficiency of the company’s credit and collection processes and plays a crucial role in evaluating and managing cash flow.

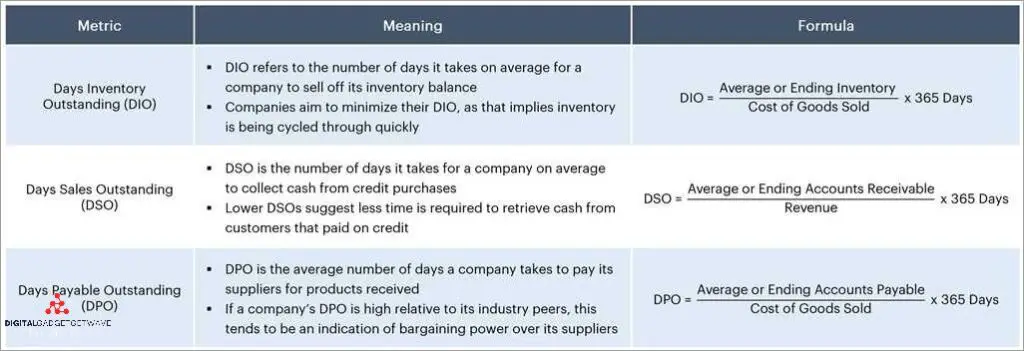

Calculating DSO

DSO, or Days Sales Outstanding, is a financial metric commonly used to measure the average number of days it takes for a company to collect payment from its customers after a sale. It is a key indicator of a company’s liquidity and efficiency in managing its accounts receivable.

To calculate DSO, the following formula is commonly used:

DSO = Accounts Receivable / (Net Sales / Number of Days)

The Accounts Receivable represents the total amount of money owed to the company by its customers, while Net Sales refers to the total amount of revenue generated by the company after deducting sales discounts or returns.

The Number of Days is the time period over which the calculation is made, which is typically a month or a quarter.

By using the formula, DSO can be calculated, which is denoted as a number of days. It signifies the average number of days it takes for a company to collect payment after a sale.

DSO is an important metric in financial analysis as it represents the efficiency of the company’s credit and collection policies, as well as the effectiveness of its accounts receivable management.

A lower DSO usually means that a company collects payments from its customers quickly, indicating effective credit and collection strategies. On the other hand, a higher DSO may indicate that a company faces difficulties in collecting payments, which can affect its cash flow and overall financial health.

DSO in Technology and Computing

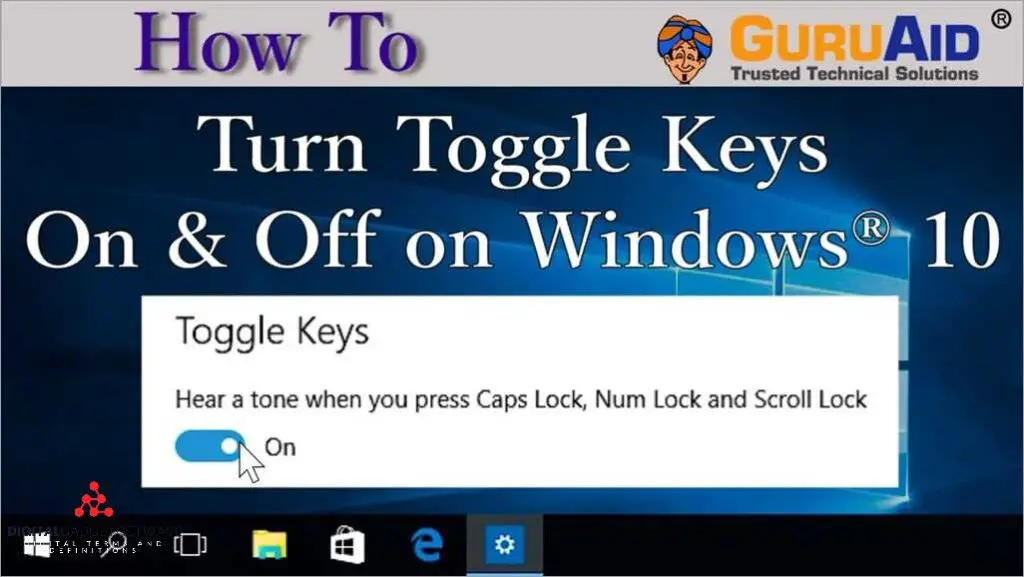

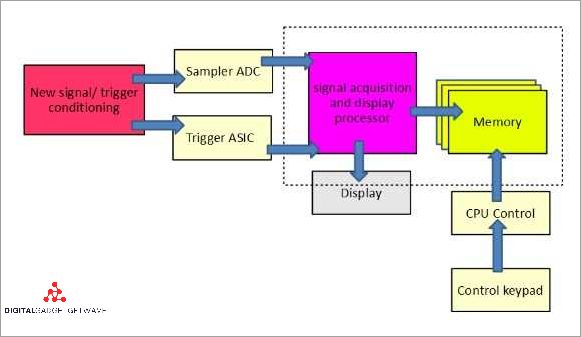

DSO is a term commonly used in the field of technology and computing. It is an abbreviation that represents the phrase “Digital Storage Oscilloscope”. The acronym DSO stands for a specific type of oscilloscope that is used to measure and analyze digital signals.

When we say DSO, we are denoting a specific type of oscilloscope that is capable of capturing and storing digital waveforms. Unlike traditional oscilloscopes, which can only display analog signals in real-time, DSOs have the ability to capture digital signals and convert them into a series of digital samples for analysis.

The meaning of DSO stems from its purpose and capabilities. The term signifies the ability of the oscilloscope to store and analyze digital waveforms, hence the term “Digital Storage Oscilloscope”. This type of oscilloscope is commonly used in various industries, such as electronics, telecommunications, and research laboratories, to analyze and troubleshoot digital circuits.

To summarize, DSO in the context of technology and computing refers to a specific type of oscilloscope, namely the Digital Storage Oscilloscope. This term represents the capabilities of the oscilloscope to store and analyze digital waveforms, making it an essential tool in various industries and applications.

Digital Storage Oscilloscope (DSO)

The term Digital Storage Oscilloscope (DSO) is an acronym that represents a type of oscilloscope used in electronics. The term “digital” in DSO signifies that the oscilloscope uses digital technology to capture, store, and analyze waveforms. The term “storage” denotes the ability of the oscilloscope to store waveforms in a digital format, allowing for further analysis and processing.

DSOs are widely used in various applications, including research, development, and troubleshooting of electronic circuits. They offer several advantages over analog oscilloscopes, such as the ability to capture and analyze complex waveforms, store multiple waveforms for comparison, and the convenience of digital processing.

A DSO typically consists of a display screen, input channels, controls, and a processing unit. It can capture and display waveforms in real-time, providing a visual representation of electrical signals. The captured waveforms can be stored in memory for later analysis and can also be transferred to a computer for further processing.

The DSO represents a significant advancement in oscilloscope technology compared to its analog predecessor. Its digital nature allows for advanced features, such as signal analysis, automatic measurements, and the ability to save and recall waveforms. These features make DSOs an essential tool for engineers, technicians, and researchers working with electronic circuits.

DSO in Other Contexts

In addition to its use in the finance industry, the acronym DSO has several other denotations. In the world of music, DSO stands for the Detroit Symphony Orchestra. This famous orchestra, founded in 1887, is known for its exceptional performances and recordings.

DSO can also represent the Digital Saltwater Optimization technology, used in the pool industry. This innovative system helps pool owners maintain clean and balanced water by continuously monitoring and adjusting the salt level.

Another interesting use of DSO is in the field of dentistry. In this context, DSO stands for Dental Service Organization. A DSO is responsible for managing the business aspect of dental practices, allowing dentists to focus on patient care.

Furthermore, DSO can signify the Danish Standards Organization. This organization is responsible for developing and maintaining various standards in Denmark, ensuring quality and safety in different industries.

In the world of technology, DSO represents Direct Store Operations, a system that allows companies to manage and optimize their retail store operations. This includes tasks such as inventory management, sales tracking, and staff scheduling.

Lastly, in the realm of telecommunications, DSO stands for Digital Signal One. DSO is a standard digital transmission format used for voice and data transmission. It is widely used in telecommunications networks, especially in Europe, to ensure efficient and reliable communication.

As we can see, the term DSO has multiple meanings and applications in different industries. The specific definition of DSO depends on the context in which it is used, but it always signifies an abbreviation or acronym that represents something significant within that field.

DSO in the Medical Field

In the context of the medical field, DSO stands for Dental Service Organization. What does this acronym signify? Well, it represents a type of organization that provides non-clinical administrative support to dental practices. DSOs are essentially management companies that handle various aspects of running a dental practice, allowing dentists to focus on providing quality care to their patients.

DSOs can offer services such as human resources, marketing, billing and insurance management, appointment scheduling, and more. These organizations function as a centralized support system for dental practices, taking care of the administrative tasks that can be time-consuming for dentists.

DSOs are becoming increasingly common in the dental field as they provide advantages for both dentists and patients. For dentists, partnering with a DSO allows them to leverage the expertise and resources of the organization, freeing up their time to focus on patient care. Patients also benefit from DSOs as they often result in improved access to dental services, streamlined appointment scheduling, and better overall management of their dental care.

In summary, DSO in the medical field, specifically in dentistry, stands for Dental Service Organization. It denotes an organization that offers non-clinical administrative support to dental practices, allowing dentists to dedicate their time to patient care. DSOs bring numerous benefits to both dentists and patients, making them an increasingly popular option in the dental industry.

DSO in the Music Industry

DSO in the music industry denote the term “Digital Service Organization”. This acronym signifies a company or entity that provides digital services related to music. DSOs are responsible for the distribution and streaming of music through various online platforms.

The term DSO is an abbreviation used to represent the meaning of a digital service organization. It stands for the definition of a company or platform that facilitates the distribution and consumption of music online.

DSOs can include streaming platforms like Spotify, Apple Music, and Tidal, as well as online music stores such as iTunes and Amazon Music. These organizations play a significant role in the music industry by providing a platform for artists and musicians to reach a wider audience and monetize their work.

DSOs also serve as a means for music fans to discover new artists and genres, as they offer curated playlists and personalized recommendations based on user preferences. They often utilize algorithms and data analysis to provide users with a tailored music experience.

The rise of DSOs in recent years has transformed the music industry, shifting the way music is consumed and distributed. It has disrupted traditional models of record labels and physical sales, making digital platforms the primary means of accessing and enjoying music.

In conclusion, DSO in the music industry represents the denomination of a Digital Service Organization. This acronym signifies the role and function of companies and platforms that provide digital music services. DSOs play a crucial role in the distribution and consumption of music online, offering opportunities for artists and listeners alike.

FAQ about topic “DSO Decoded: Understanding the Meaning Behind the Acronym”

What does DSO stand for?

DSO stands for Days Sales Outstanding. It is a financial metric that represents the average number of days it takes for a company to collect payment after a sale has been made. It is calculated by dividing accounts receivable by average daily sales.

How is DSO calculated?

DSO is calculated by dividing the total accounts receivable by the average daily sales. The formula is DSO = (Accounts Receivable / Average Daily Sales) x Number of Days in Period.

Why is DSO important for businesses?

DSO is important for businesses as it helps them assess their credit and collection efficiency. It provides insights into how quickly a company is able to collect payment for its sales. A low DSO indicates that a business is efficient in collecting payments, while a high DSO may indicate that a business is facing issues with collecting outstanding receivables.

How can a company reduce its DSO?

A company can reduce its DSO by implementing various strategies such as offering incentives for early payment, improving its credit and collection policies, conducting regular credit checks on customers, and establishing clear payment terms and deadlines. Additionally, implementing an efficient accounts receivable management system can also help in reducing DSO.

What are the limitations of using DSO as a metric?

While DSO is a useful metric, it has some limitations. Firstly, it does not take into account the quality of the accounts receivable. A company may have a low DSO but still have a high number of delinquent accounts. Secondly, DSO can be influenced by seasonal variations in sales, so it may not provide an accurate picture of a company’s overall collection efficiency. Finally, DSO does not consider the timing and amount of cash inflows, which can also affect a company’s liquidity.