In today’s competitive market, having a strong portfolio management strategy is crucial for any organization to stay ahead. A portfolio manager IT is an expert in utilizing quant technology to optimize asset allocation, improve trading performance, and maximize return on investment (ROI). With their deep understanding of financial markets and risk management, these managers play a vital role in driving the success of hedge funds, equity research firms, and other investment institutions.

As a portfolio manager IT, one must possess a strong analytical mindset and exceptional quantitative skills. They are responsible for conducting extensive market research, analyzing valuation models, and assessing risk factors to identify profitable investment opportunities. By utilizing advanced quantitative techniques and financial models, they can make informed decisions on asset allocation and trading strategies, ensuring optimal performance for their portfolio.

Moreover, the portfolio manager IT is instrumental in bridging the gap between the financial and technological aspects of the industry. They work closely with technology teams to develop and implement cutting-edge software solutions that streamline portfolio management processes. By leveraging automation and data analytics, managers can efficiently track portfolio performance, monitor market trends, and make real-time adjustments to their investment strategies.

In summary, the role of a portfolio manager IT is crucial in today’s financial landscape. By combining their expertise in quantitative analysis and technology, these professionals enhance project performance and maximize ROI for their organizations. They play a pivotal role in managing capital, mitigating risks, and ultimately driving financial success in the ever-evolving market.

Contents

- 1 Portfolio Management in the IT sector

- 2 Role of a Portfolio Manager

- 3 Enhancing Project Performance through Portfolio Management

- 4 Maximizing Return on Investment (ROI) through Portfolio Management

- 5 FAQ about topic “Portfolio Manager IT: Enhancing Project Performance and Maximizing ROI”

- 6 What is a portfolio manager in the IT industry?

- 7 How does a portfolio manager enhance project performance?

- 8 What techniques can a portfolio manager use to maximize ROI?

- 9 What are the key skills and qualifications required for a portfolio manager in the IT industry?

- 10 How can a portfolio manager ensure successful project delivery?

Portfolio Management in the IT sector

Portfolio management plays a crucial role in the IT sector, where managers are responsible for making investment decisions and maximizing the return on capital. These professionals analyze and evaluate various projects and allocate resources strategically to optimize performance and achieve the desired outcomes.

IT portfolio managers oversee a diverse range of assets, including equity investments, software development projects, and IT infrastructure. They employ quantitative valuation techniques and risk assessments to determine the potential of each asset and design an effective portfolio strategy.

Portfolio managers in the IT sector also collaborate with analysts and research teams to stay updated on market trends and identify emerging opportunities. They utilize their financial expertise to make informed investment decisions, whether it’s investing in a promising startup or funding the development of a new technology.

Furthermore, portfolio managers in IT may also manage hedge funds or engage in trading activities to diversify their portfolios and generate additional returns. Their expertise in financial markets and risk management allows them to navigate complex investment landscapes and deploy capital effectively.

In summary, portfolio management in the IT sector involves the analysis, evaluation, and allocation of resources to maximize performance and achieve the desired return on investment. These professionals utilize quantitative valuation techniques, collaborate with analysts and research teams, and make informed investment decisions to optimize portfolio performance in the dynamic and ever-evolving IT industry.

Importance of portfolio management

Investment: Portfolio management is essential for effective investment strategies. By carefully selecting and managing a collection of assets, a portfolio manager can maximize returns and minimize risks.

Research: A portfolio manager conducts extensive research to identify suitable investments. They analyze market trends, evaluate company performance, and gather information from various sources to make informed investment decisions.

Strategy: Portfolio management involves developing and implementing investment strategies based on the client’s objectives and risk tolerance. The portfolio manager considers factors such as asset allocation, diversification, and timing to optimize portfolio performance.

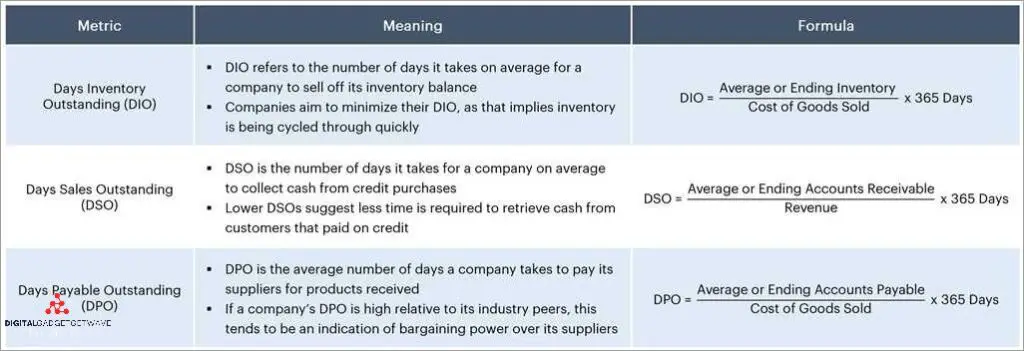

Quantitative Analysis: Portfolio managers use quantitative models and tools to analyze financial data and assess the potential risks and returns of different investment options. This allows them to make data-driven investment decisions.

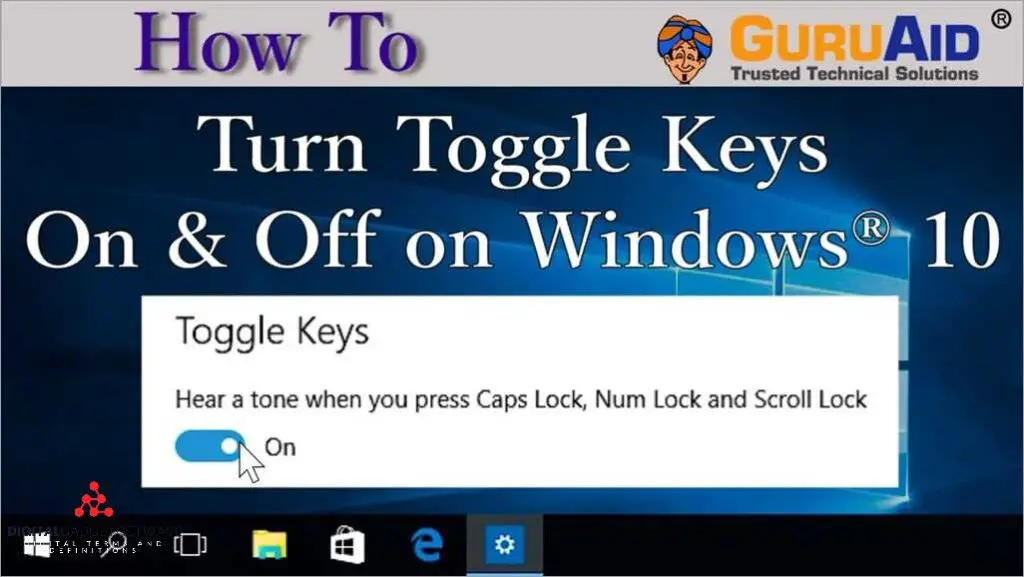

Technology: Portfolio managers leverage technology to streamline portfolio management processes. They use advanced portfolio management software to track portfolio performance, analyze data, and generate reports for clients.

Capital Allocation: A portfolio manager allocates capital among different investments to achieve the desired risk-return tradeoff. They consider factors such as the expected returns, volatility, and correlation of various assets when allocating capital.

Risk Management: Portfolio management involves actively managing and mitigating risks associated with investments. A portfolio manager assesses the potential risks and implements strategies to protect the portfolio against adverse market conditions.

Financial Valuation: Portfolio managers conduct financial valuation of assets to determine their fair value. They analyze financial statements, perform valuation models, and consider market conditions to determine the worth of investments.

Tracking Performance: Portfolio managers regularly monitor and evaluate the performance of the portfolio. They compare the actual performance against the expected performance and make necessary adjustments to optimize returns.

Portfolio Diversification: Portfolio managers diversify the investments across different asset classes, sectors, and regions to reduce the overall risk of the portfolio. This helps in maximizing returns while minimizing the impact of any single investment.

Maximizing ROI: Through effective portfolio management, portfolio managers aim to maximize the return on investment for their clients. They seek opportunities in the market and make informed decisions to generate higher returns.

Benefits of effective portfolio management

Effective portfolio management brings a wide range of benefits to organizations operating in the market. It enables companies to achieve their financial objectives by aligning their IT investments with business strategy. By carefully analyzing market trends and leveraging the expertise of analysts, portfolio managers can identify potential risks and make informed investment decisions.

One of the key benefits of effective portfolio management is optimizing trading strategies. By analyzing market data and utilizing quantitative research techniques, portfolio managers can develop trading strategies that maximize returns while minimizing risk. This can result in improved fund performance and increased capital gains for investors.

Effective portfolio management also plays a crucial role in asset valuation. By conducting thorough financial research and utilizing advanced valuation models, portfolio managers can accurately assess the value of different investment assets. This helps in making informed decisions regarding asset allocation and portfolio diversification.

Furthermore, effective portfolio management allows organizations to leverage technology for better performance. By utilizing advanced software and analytics tools, portfolio managers can automate processes, improve data analysis, and make timely investment decisions. This not only enhances the efficiency of portfolio management but also ensures better overall performance.

Another significant benefit of effective portfolio management is risk mitigation. By carefully monitoring and evaluating the risk associated with different investments, portfolio managers can proactively minimize potential losses. This helps in safeguarding the interests of investors and ensuring the long-term sustainability of the portfolio.

In conclusion, effective portfolio management brings numerous benefits to organizations. It not only enhances trading strategies and asset valuation but also leverages technology for better performance and mitigates risks. By optimizing portfolio management, organizations can maximize ROI, achieve financial objectives, and gain a competitive edge in the market.

Role of a Portfolio Manager

A portfolio manager plays a crucial role in managing a portfolio of investments. They are responsible for making investment decisions, managing risk, and maximizing returns for clients or investors. The role requires a combination of financial expertise, market research, and strategic thinking.

Portfolio managers use various tools and techniques to evaluate the performance and potential of investments. They conduct quantitative and qualitative analysis to assess the valuation of equities, bonds, and other financial instruments. This includes analyzing market trends, conducting company research, and evaluating the risk-return profile of different assets.

Portfolio managers also develop and implement investment strategies based on their analysis and market insights. They consider factors such as market conditions, client objectives, and risk tolerance to construct a diversified portfolio. This involves selecting a mix of assets across different sectors, regions, and asset classes to optimize returns while managing risk.

Risk management is a key aspect of a portfolio manager’s role. They continuously monitor and assess the risk exposure of the portfolio and make adjustments as needed. They may hedge against potential risks through various strategies such as diversification, using derivatives, or employing hedging techniques.

Technology plays a vital role in portfolio management. Portfolio managers use advanced software and tools to track performance, analyze data, and make informed investment decisions. They leverage technology to automate processes, improve efficiency, and enhance portfolio performance.

In summary, a portfolio manager is a financial professional who manages a portfolio of investments on behalf of clients or investors. They utilize their financial expertise, market research, and risk management skills to make informed investment decisions and maximize returns while managing risk. Technology plays a crucial role in supporting their activities, enabling them to analyze data, track performance, and implement effective investment strategies.

Responsibilities of a portfolio manager

A portfolio manager is responsible for managing a collection of investments, such as stocks, bonds, and other financial assets, on behalf of clients or an organization. They play a crucial role in optimizing the performance of the portfolio and maximizing return on investment.

One of the key responsibilities of a portfolio manager is conducting research and analysis to identify investment opportunities. They need to stay updated with market trends, economic indicators, and industry news to make informed decisions. This involves evaluating the financial health of companies, analyzing their growth potential, and assessing risk factors.

A portfolio manager also develops investment strategies based on their research and analysis. They create a diversified portfolio that aligns with the client’s goals and risk tolerance. This involves allocating resources across different asset classes, such as stocks, bonds, and alternative investments like private equity or hedge funds.

Monitoring the performance of the portfolio is another crucial responsibility. A portfolio manager regularly assesses the returns of individual investments and the overall portfolio. They track market trends, evaluate risk exposure, and make necessary adjustments to optimize performance and manage potential risks.

In addition to managing the financial aspects, a portfolio manager may also oversee the technological infrastructure and tools used for trading and analysis. They need to stay updated with the latest technology and implement quantitative models and algorithms to enhance decision-making and improve portfolio valuation.

A portfolio manager may also collaborate with other professionals, such as risk managers, traders, and quantitative analysts, to ensure cohesive and effective portfolio management. They need to communicate effectively with clients, providing regular updates on portfolio performance, explaining investment decisions, and addressing any concerns or questions.

To sum up, the responsibilities of a portfolio manager include conducting research and strategy development, managing financial assets and portfolio performance, implementing technology for analysis and trading, and collaborating with various professionals to ensure effective portfolio management and client satisfaction.

Skills required for portfolio management

Portfolio managers require a diverse set of skills to effectively manage a portfolio and maximize performance in the financial market. Here are some key skills that are essential for a portfolio manager:

- Financial market knowledge: A portfolio manager should have a deep understanding of financial markets, including trading dynamics, market trends, and investment strategies. This knowledge is crucial for making informed decisions and optimizing portfolio performance.

- Asset valuation: The ability to accurately assess the value of assets is vital for a portfolio manager. This includes analyzing financial statements, conducting due diligence, and utilizing various valuation techniques to determine the worth of the portfolio.

- Risk management: Portfolio managers must have strong risk management skills to identify and mitigate potential risks. This involves evaluating risk factors, developing risk management strategies, and implementing risk control measures to protect the portfolio from adverse market conditions.

- Quantitative analysis: A portfolio manager needs to have a solid understanding of quantitative analysis techniques. This includes using statistical models, data analysis, and mathematical tools to identify investment opportunities and optimize portfolio performance.

- Research and analysis: Conducting thorough research and analysis is a key skill for a portfolio manager. This involves staying updated with market trends, analyzing investment opportunities, and evaluating the performance of existing investments to make informed decisions.

- Technology proficiency: In today’s dynamic financial market, technology plays a crucial role in portfolio management. A portfolio manager should have strong technology skills to effectively utilize portfolio management software, data analysis tools, and trading platforms to enhance performance and efficiency.

By possessing these skills, a portfolio manager can effectively navigate the complex world of financial markets, develop successful investment strategies, and maximize the return on investment for their clients or organizations.

Enhancing Project Performance through Portfolio Management

Portfolio management is a quantitative approach to optimizing project performance and maximizing return on investment (ROI). It involves the valuation and selection of a portfolio of projects, managed by a portfolio manager who seeks to align the projects with the overall objectives and strategy of the organization.

A portfolio manager utilizes various tools and techniques, such as financial modeling and risk analysis, to evaluate the potential of each project and to allocate capital resources accordingly. They act as a quant strategist, conducting research and analysis to identify market trends and opportunities for investment.

In the IT industry, portfolio management plays a crucial role in enhancing project performance. By carefully selecting and managing a portfolio of IT projects, a company can ensure that its investments in technology are aligned with its strategic goals. This includes assessing the risk associated with each project and implementing effective risk management strategies to mitigate potential pitfalls.

Portfolio managers in IT often have expertise in areas such as technology, trading, and investment analysis. They leverage this knowledge to determine the optimal allocation of resources and to identify potential synergies between different projects. This approach not only enhances project performance but also maximizes the overall impact and value of the IT investments made by the organization.

Furthermore, portfolio management enables companies to prioritize and allocate resources to projects that have the highest potential for generating value. By evaluating the performance of each project and making data-driven decisions, portfolio managers can ensure that the organization’s capital is invested in the most profitable and strategically aligned initiatives.

In conclusion, portfolio management is a vital strategy for enhancing project performance in the IT industry. By employing quantitative analysis, valuation techniques, and risk management strategies, portfolio managers can optimize the allocation of resources and maximize the return on investment. This approach enables companies to strategically invest in IT projects that align with their objectives and drive overall business success.

Aligning projects with organizational goals

As a portfolio manager responsible for enhancing project performance and maximizing ROI, it is crucial to align projects with the organization’s goals. This ensures that the allocation of resources and investments contributes directly to the overall success of the organization.

To achieve this alignment, the portfolio manager must have a thorough understanding of the organization’s strategic objectives and risk appetite. By combining this knowledge with financial valuation techniques and market research, the manager can identify projects that align with the organization’s goals and have the potential to generate significant returns.

In the IT industry, projects often involve the development and implementation of technology solutions. The portfolio manager must assess the equity and allow the organization to hedge against emerging technology risks. This requires collaboration with IT analysts and quant experts to evaluate the potential risks and rewards of different projects. By analyzing and optimizing the project mix, the portfolio manager can ensure that the IT investments align with the organization’s overall strategy.

Furthermore, the portfolio manager should consider the market dynamics and trends in the technology sector. By staying informed about advancements and disruptions, the manager can adjust the project portfolio to capitalize on opportunities and mitigate risks. This requires continuous monitoring and research to assess the market conditions and make informed decisions.

Overall, aligning projects with organizational goals is a critical task for a portfolio manager. By combining financial analysis, market research, and IT expertise, the manager can optimize the project portfolio to enhance performance and maximize ROI. The strategic allocation of resources and investments in technology projects ensures that the organization remains competitive and achieves its long-term objectives.

Prioritizing projects based on resources and strategic objectives

As a Portfolio Manager IT, one of the key responsibilities is to prioritize projects based on available resources and strategic objectives. This involves assessing project risks, evaluating technology requirements, and considering equity in the portfolio. By carefully analyzing each project’s potential valuation and alignment with the organization’s strategic goals, the portfolio manager can ensure that resources are allocated efficiently and effectively.

The portfolio manager also plays a crucial role in managing hedge funds and investment strategies. By utilizing quantitative models and market research, they can identify high-performing assets and make informed investment decisions. This requires a deep understanding of financial markets, trading strategies, and analytical skills to maximize the fund’s performance and generate optimal returns for investors.

Additionally, the portfolio manager collaborates with analysts and research teams to stay updated on industry trends and market conditions. This constant monitoring allows them to adjust investment strategies and asset allocation, ensuring that the portfolio remains aligned with the organization’s goals and delivers competitive returns. By staying ahead of market changes and proactively managing the portfolio, the manager can capitalize on opportunities and mitigate potential risks.

Effective portfolio management also involves optimizing the allocation of capital across different projects and assets. By considering various factors such as risk, performance, and market conditions, the portfolio manager can determine the optimal distribution of resources to maximize returns. This requires strong analytical skills, financial expertise, and a deep understanding of the organization’s overall strategy.

- Assessing project risks

- Evaluating technology requirements

- Considering equity in the portfolio

- Analyzing potential valuation

- Aligning with strategic goals

- Utilizing quantitative models and market research

- Managing hedge funds and investment strategies

- Collaborating with analysts and research teams

- Optimizing capital allocation

Maximizing Return on Investment (ROI) through Portfolio Management

Portfolio management is a strategic approach that seeks to maximize return on investment (ROI) by carefully selecting and managing a diverse portfolio of investments. It enables investors to effectively allocate their capital across various investment opportunities in order to achieve their financial goals. In the market, portfolio managers are responsible for making investment decisions based on thorough research and analysis of market trends, risk factors, and potential returns.

One key role in portfolio management is that of a financial analyst, who studies market data and trends to identify promising investment opportunities. They use quantitative analysis, valuation techniques, and risk models to evaluate the performance and potential of various assets, such as stocks, bonds, hedge funds, and private equity. This analysis helps in making informed investment decisions and optimizing the portfolio’s risk-return profile.

Technology plays a vital role in enhancing portfolio management. Sophisticated algorithms and quantitative models enable portfolio managers to execute trading strategies based on real-time market data and risk analysis. Quantitative analysts are responsible for developing and testing these models to improve investment performance. By leveraging technology, portfolio managers can make data-driven decisions and adjust their strategies in response to market changes.

Portfolio managers also utilize research from various sources, including investment banks, research firms, and in-house analysts, to identify new opportunities and refine their investment strategies. By considering multiple perspectives and conducting thorough due diligence, they aim to maximize portfolio performance and mitigate potential risks.

Furthermore, portfolio managers actively monitor and adjust the portfolio’s composition to optimize its performance. They regularly review and rebalance the portfolio based on changes in market conditions and investment goals. This ensures that the portfolio remains aligned with the investor’s objectives and maximizes returns while minimizing risks.

In conclusion, portfolio management is a strategic approach that aims to maximize ROI by carefully selecting and managing a diverse portfolio of investments. It involves thorough research, analysis, and the use of technology to identify opportunities, mitigate risks, and optimize the performance of the portfolio. By effectively allocating capital and continuously monitoring and adjusting the portfolio, investors can maximize their returns and achieve their financial goals.

Optimizing project selection and resource allocation

In the rapidly changing market of technology and investments, it is crucial for portfolio managers to optimize project selection and resource allocation in order to maximize returns. This requires a deep understanding of the market trends, financial analysis, and risk management.

Portfolio managers act as hedge fund managers, quant analysts, or financial strategists, responsible for identifying and evaluating potential projects. They use their expertise in investment valuation and risk assessment to determine which projects align with the organization’s goals and have the potential for high performance.

By utilizing quantitative trading strategies and advanced technology tools, portfolio managers can assess project performance and allocate resources accordingly. They analyze data, track market trends, and evaluate investment opportunities to identify projects with high return potential.

Resource allocation plays a critical role in optimizing project selection. Portfolio managers must prioritize projects based on their potential return on investment and available capital. They carefully assess the expected value and risk of each project to allocate resources effectively and ensure a balanced portfolio.

This optimization process involves constant monitoring and evaluation of project performance. Portfolio managers regularly review the asset allocation, track the progress of ongoing projects, and make necessary adjustments to the resource allocation strategy. This ongoing evaluation allows for efficient utilization of resources and maximizes overall portfolio performance.

To summarize, optimizing project selection and resource allocation requires a combination of financial expertise, quantitative analysis, and risk management. Portfolio managers act as strategists, using advanced technology tools to assess project performance and make informed decisions. By prioritizing projects and continuously evaluating their performance, portfolio managers can maximize returns and minimize risk for their organization.

Monitoring and controlling project performance

Monitoring and controlling project performance is a crucial aspect of effective portfolio management in the IT industry. It involves the systematic evaluation and measurement of the progress, risk, and financial implications of projects in order to ensure their success and maximize return on investment.

Quantitative data analysis plays a vital role in monitoring and controlling project performance. Portfolio managers rely on quantitative models and tools to analyze various project metrics and indicators, such as cost, schedule, quality, and scope. These models help in identifying potential risk factors and deviations from the planned objectives, enabling timely corrective actions to be taken.

Financial analysis is another integral component of monitoring and controlling project performance. Portfolio managers use financial techniques to assess the profitability, liquidity, and overall financial health of projects. By examining project costs, revenues, and cash flows, they can determine the financial feasibility and viability of a project, as well as its potential impact on the overall portfolio.

Technology also plays a vital role in monitoring and controlling project performance. Advanced project management software and tools provide real-time visibility into project status, allowing portfolio managers to track progress, identify bottlenecks, and make informed decisions. These technologies enable effective communication and collaboration among team members, ensuring seamless project execution.

In addition to quantitative and financial analysis, portfolio managers employ various risk management strategies to monitor and control project performance. They conduct thorough risk assessments, identify potential risks, and develop mitigation plans. By continuously monitoring project risks and implementing appropriate risk response strategies, portfolio managers can minimize the impact of uncertainties on project outcomes.

Overall, effective monitoring and controlling of project performance requires a combination of quantitative analysis, financial evaluation, technological tools, and risk management strategies. By holistically assessing project performance and making informed decisions, portfolio managers can enhance project success and maximize return on investment for their IT portfolios.

FAQ about topic “Portfolio Manager IT: Enhancing Project Performance and Maximizing ROI”

What is a portfolio manager in the IT industry?

A portfolio manager in the IT industry is responsible for managing a portfolio of projects within a company. They oversee the planning, execution, and monitoring of multiple projects to ensure they align with the company’s strategic goals. Their role is to optimize the allocation of resources, manage risks, and ensure projects are delivered on time and within budget.

How does a portfolio manager enhance project performance?

A portfolio manager enhances project performance by implementing effective project management methodologies and best practices. They closely monitor project progress, identify and address issues in a timely manner, and make adjustments to the project plans as needed. They also facilitate effective communication between project teams and stakeholders, provide guidance and support, and ensure that projects are aligned with the company’s overall strategy.

What techniques can a portfolio manager use to maximize ROI?

A portfolio manager can use various techniques to maximize ROI, such as prioritizing projects based on their potential value and return on investment, conducting thorough feasibility studies and cost-benefit analyses, and making informed investment decisions. They also continuously monitor the performance of ongoing projects and make adjustments to optimize resource allocation and mitigate any risks that may impact the ROI. Furthermore, they evaluate the post-implementation results and identify areas for improvement to enhance future ROI.

What are the key skills and qualifications required for a portfolio manager in the IT industry?

Key skills and qualifications required for a portfolio manager in the IT industry include strong project management skills, excellent organizational and analytical abilities, effective communication and stakeholder management skills, and a deep understanding of IT systems and technologies. They should also have solid knowledge of business strategy and financial analysis, as well as experience in managing complex IT projects and portfolios.

How can a portfolio manager ensure successful project delivery?

A portfolio manager can ensure successful project delivery by developing robust project management processes and methodologies, establishing clear project goals and objectives, and setting realistic expectations. They should also carefully select and allocate resources, ensure effective communication and collaboration between project teams, and proactively manage risks and issues. Additionally, they should regularly monitor project performance, provide guidance and support to the project teams, and make timely adjustments to the project plans to ensure successful delivery.