BSB is an acronym that stands for “Backstreet Boys”. This popular American boy band rose to fame in the 1990s and became a global sensation. Consisting of members AJ McLean, Howie Dorough, Nick Carter, Kevin Richardson, and Brian Littrell, the Backstreet Boys became known for their catchy pop songs, synchronized dance routines, and boy-next-door charm.

But BSB can also refer to other things besides the Backstreet Boys. In the banking world, BSB is an abbreviation for “Bank-State-Branch”. The BSB number is a unique identifier used in Australia to identify individual bank branches. It helps facilitate electronic transactions and direct deposits.

Furthermore, BSB can also stand for “Bachelor of Science in Business”. This degree program focuses on providing students with a strong foundation in business principles, such as marketing, finance, and management. Graduates with a BSB degree are equipped with the knowledge and skills necessary to pursue careers in various industries, including banking, consulting, and entrepreneurship.

So, whether you’re a fan of the Backstreet Boys, interested in banking terminology, or considering pursuing a degree in business, it’s important to understand what BSB means in each context. By delving into the meanings behind the acronym, you can gain a deeper understanding of the topic at hand.

Contents

- 1 The Definition of BSB

- 2 Origin and History of BSB

- 3 Importance and Impact of BSB

- 4 Section 2: Common Uses of BSB

- 5 Section 3: Benefits and Advantages of BSB

- 6 Section 4: Future Trends and Developments in BSB

- 7 FAQ about topic “What Does BSB Mean? Find Out Everything Here”

- 8 What is the full form of BSB?

- 9 How many members are there in BSB?

- 10 What are some of the popular songs of BSB?

- 11 When did BSB release their debut album?

- 12 What is the history of BSB?

The Definition of BSB

BSB stands for Bank-State-Branch. It is a unique code used in the banking system to identify specific banks and branches within a country. The BSB code is primarily used in Australia and is similar to other banking codes such as the routing number used in the United States.

The BSB code consists of six digits and is divided into two parts. The first two digits represent the bank code, which identifies the financial institution. The next two digits represent the state code, indicating the state or territory where the branch is located. The final two digits represent the branch code, which identifies the specific branch within the state. This code is used for various banking transactions such as electronic funds transfers and direct debits.

Knowing the BSB of a bank branch is essential for making accurate and timely transactions. It ensures that the funds are correctly directed to the intended bank and branch. Additionally, the BSB code helps ensure the security and efficiency of the banking system by preventing errors and misdirected transactions.

When conducting banking transactions in Australia, it is important to accurately provide the BSB code along with the recipient’s account number. This information is usually found on the recipient’s bank statement or by contacting the bank directly. By including the correct BSB code, individuals can ensure that their funds are transferred to the correct bank and branch, avoiding delays and potential errors.

Origin and History of BSB

BSB is an acronym that stands for Backstreet Boys. The Backstreet Boys is an American boy band that gained massive popularity in the late 1990s and early 2000s. The band consists of members AJ McLean, Howie Dorough, Nick Carter, Kevin Richardson, and Brian Littrell.

Formed in 1993 in Orlando, Florida, the Backstreet Boys originally started as a vocal harmony group. Under the management of Lou Pearlman, they quickly rose to fame and became one of the best-selling boy bands of all time. Their music incorporates elements of pop, R&B, and dance.

The Backstreet Boys released their self-titled debut album in 1996, which achieved moderate success. However, it was their second album, “Backstreet’s Back,” released in 1997, that catapulted them to international stardom. The album spawned several hit singles, including “Quit Playing Games (With My Heart)” and “Everybody (Backstreet’s Back).”

Throughout the late 1990s and early 2000s, the Backstreet Boys continued to dominate the music charts with their albums “Millennium” and “Black & Blue.” They sold millions of records worldwide and performed in sold-out arenas around the globe.

After a brief hiatus in the early 2000s, the Backstreet Boys made a successful comeback in 2005 with their album “Never Gone.” They have since released several more albums and embarked on numerous tours.

The Backstreet Boys have left a lasting impact on the music industry and have a dedicated fan base that continues to support them. Their harmonious vocals, catchy melodies, and energetic performances have made them one of the most iconic boy bands in history.

Importance and Impact of BSB

The acronym BSB stands for Bank State Branch, which refers to a unique identifier used in the banking industry to identify specific branches of a bank. This code plays a crucial role in ensuring secure and efficient banking transactions.

Understanding what BSB means is important for both individuals and businesses who engage in banking activities. When making a payment or transferring funds, the BSB code is used to specify the exact branch where the transaction should take place. This helps to streamline the process and ensure that funds are efficiently transferred to the correct location.

The impact of BSB is significant as it enables banks to operate smoothly and seamlessly. By using a standardized code for branch identification, banks can easily process transactions, reconcile accounts, and maintain accurate records. This reduces the chances of errors and enhances the overall efficiency of banking operations.

Furthermore, the BSB code is also crucial for international transactions. It allows international banks to identify the specific domestic branch of an Australian bank, enabling them to send and receive funds securely. This promotes international trade and facilitates global financial transactions.

In conclusion, the importance and impact of BSB cannot be underestimated. It plays a vital role in ensuring secure and efficient banking transactions, both domestically and internationally. By understanding and utilizing the BSB code correctly, individuals and businesses can facilitate seamless financial transactions and contribute to the smooth functioning of the banking industry.

Section 2: Common Uses of BSB

The BSB code, or Bank State Branch code, is widely used in the banking industry for various purposes. Here are some common uses of BSB:

- Identification: The BSB code is primarily used to identify individual branches of a bank. Each branch has a unique BSB code, which helps in distinguishing one branch from another.

- Electronic Fund Transfers: BSB codes are an essential component of electronic fund transfers, especially in countries like Australia where they are widely used. When transferring funds between different banks or accounts, the BSB code is required to ensure that the funds reach the intended branch.

- Account Number Validation: BSB codes are also used for validating bank account numbers. When setting up direct deposit or initiating transactions, combining the BSB code with the account number helps in verifying that the account details are correct.

- Online Banking: BSB codes are often required when setting up new accounts or managing existing ones through online banking platforms. Users are usually asked to input the BSB code along with their account details to authorize certain actions.

- International Banking: In international banking, the BSB code may be needed when sending funds to an Australian bank account. The BSB code serves as an additional identifier along with the standard bank account number to ensure accurate routing and delivery of funds.

These are just a few examples of the common uses of BSB codes. The code plays a crucial role in facilitating seamless financial transactions within the banking industry.

BSB in the Music Industry

BSB, which is short for Backstreet Boys, is a popular American boy band that achieved significant success in the music industry during the late 1990s and early 2000s. The group was formed in 1993 and quickly gained international fame with their catchy pop songs and synchronized dance routines.

The term “BSB” became synonymous with the Backstreet Boys, as it was often used as an abbreviation to refer to the band. Their music was characterized by melodic hooks, harmonies, and emotional lyrics, appealing to a wide range of audiences.

What set BSB apart from other boy bands at the time was their ability to connect with fans on a personal level. They often incorporated personal experiences and emotions into their songs, making their music relatable to listeners.

BSB’s success extended beyond their music, as they became cultural icons and influenced the fashion trends of the time. Their signature style, which included oversized streetwear and trendy haircuts, was widely imitated by their fans.

The group’s impact on the music industry can be seen through their record-breaking sales and numerous awards. BSB’s albums consistently topped the charts and sold millions of copies worldwide. They also received several accolades, including Grammy nominations and MTV Video Music Awards.

Overall, BSB played a significant role in shaping the music industry and leaving a lasting impact on pop culture. Even though their popularity has waned in recent years, their music continues to resonate with fans and their legacy as one of the most successful boy bands remains.

BSB in Banking and Finance

In the context of banking and finance, BSB refers to the Bank State Branch number, a unique identifier used in Australia to specify individual branches of banks. This six-digit number is commonly used for electronic funds transfer, allowing for accurate and efficient routing of funds between different bank branches within the country.

The BSB number is provided by the Reserve Bank of Australia and each bank branch is assigned a unique code. The first two digits of the BSB number indicate the bank, while the remaining four digits specify the branch. This system ensures that all financial transactions in Australia are processed correctly and securely.

BSB numbers are often required when setting up direct debits or making electronic payments. They are typically found on bank statements, on the bottom of checks, or provided by the bank itself. It is important to ensure that the correct BSB number is used to avoid any potential issues or delays in transferring funds.

Understanding the BSB system is crucial for individuals and businesses conducting financial transactions in Australia. It ensures that funds are directed to the correct branch and minimizes the risk of errors or misrouting. Banks may also provide online tools or helplines for verifying BSB numbers and providing assistance to customers.

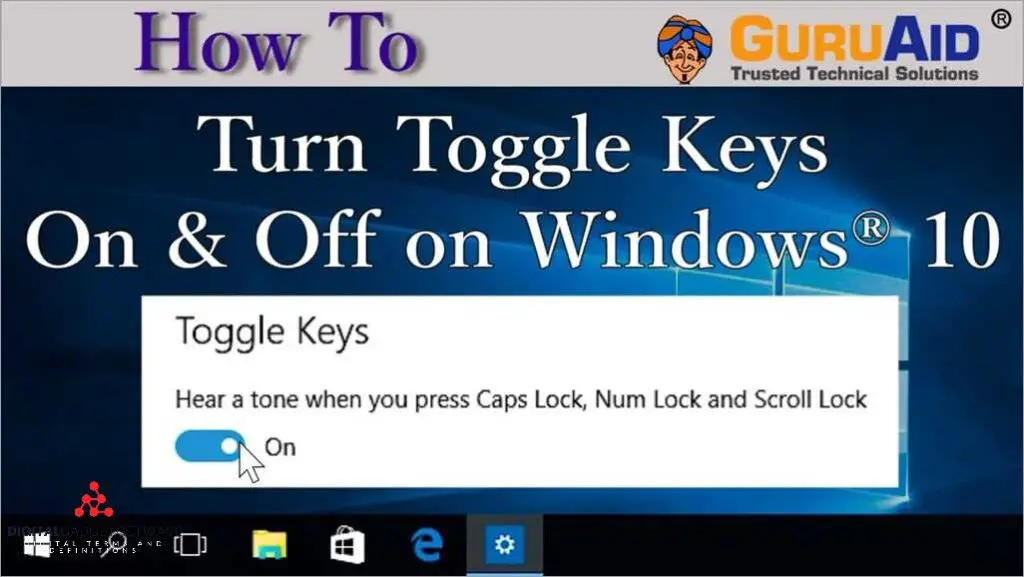

BSB in Technology and Telecommunications

In the field of technology and telecommunications, BSB stands for Base Station Subsystem. The Base Station Subsystem is a part of the Global System for Mobile Communications (GSM) network architecture, which is widely used for mobile communication around the world.

So, what does the Base Station Subsystem (BSB) mean in the context of technology and telecommunications? In simple terms, it refers to the infrastructure that supports wireless communication between mobile devices and the network. It consists of several components, including the Base Transceiver Station (BTS), Base Station Controller (BSC), and the Operation and Maintenance Center (OMC).

The Base Transceiver Station (BTS) is responsible for transmitting and receiving signals to and from mobile devices. It houses the antennas and equipment necessary for radio communication. The Base Station Controller (BSC) manages and controls multiple BTSs, allocating resources and ensuring efficient communication within the network.

The Operation and Maintenance Center (OMC) is the central hub for monitoring and managing the BSB. It provides tools and functionalities for monitoring network performance, troubleshooting issues, and configuring the base stations.

In summary, BSB in technology and telecommunications refers to the Base Station Subsystem, which is a crucial part of the GSM network architecture. It enables wireless communication between mobile devices and the network through the use of components such as the Base Transceiver Station, Base Station Controller, and Operation and Maintenance Center.

Section 3: Benefits and Advantages of BSB

BSB, which stands for “Business Suite Benefits,” is a term widely used in the business world to refer to the advantages and benefits that come with using a business suite software.

One of the main benefits of BSB is its ability to streamline and automate various business processes. By using a business suite software, companies can integrate different departments and functions, such as accounting, human resources, and customer relationship management, into a single, cohesive system. This eliminates the need for multiple software applications and reduces the time and effort required to manage and maintain them separately.

Additionally, BSB provides companies with real-time access to critical business data and analytics. With BSB, businesses can gather and analyze data from various sources, such as sales, inventory, and customer interactions, to gain valuable insights and make informed business decisions. This leads to improved efficiency, productivity, and profitability.

Moreover, BSB offers enhanced collaboration and communication capabilities. With BSB, employees can easily share and access information across different departments and locations, facilitating teamwork and ensuring that everyone is on the same page. This promotes better coordination, faster decision-making, and improved customer service.

Furthermore, BSB often comes with robust security measures to protect sensitive business data. With features like data encryption, user access controls, and regular backups, businesses can safeguard their information against unauthorized access, loss, or theft. This gives them peace of mind and reassurance that their confidential data is being kept secure.

In summary, BSB provides businesses with numerous benefits and advantages, including streamlined processes, real-time data access, enhanced collaboration, and heightened security. It significantly improves efficiency, productivity, and decision-making, making it an invaluable tool for modern businesses.

Increased Efficiency and Accuracy

The BSB system, or Bank State Branch, is a unique identifier used in Australia to streamline and improve the efficiency and accuracy of financial transactions.

Before the introduction of BSB, bank transfers and payments required lengthy manual processes and often resulted in errors and delays. With BSB, financial institutions can quickly and accurately identify the specific bank and branch associated with an account, enabling faster and more seamless transactions.

Moreover, the BSB system allows for greater accuracy in transferring funds. Each BSB code corresponds to an individual bank branch, ensuring that funds are sent to the correct recipient. This eliminates the risks of sending money to the wrong account or branch, reducing the possibility of costly errors and the need for manual intervention to rectify them.

The BSB system also improves efficiency for businesses and organizations that process a large volume of financial transactions. With BSB, they can easily automate their payment processes by integrating the BSB code into their systems. This automated approach saves time and reduces the potential for human error, ultimately increasing efficiency and productivity.

Overall, the BSB system plays a crucial role in enhancing the efficiency and accuracy of financial transactions in Australia. By providing a standardized and reliable method of identifying bank branches, BSB drives faster and more precise money transfers, reducing errors and improving overall financial operations.

Enhanced Security and Fraud Prevention

Banks play a crucial role in ensuring the security of customer’s funds and transactions. In this era of digital banking, where transactions are primarily conducted online, it is of utmost importance for banks to implement robust security measures. This is where BSB comes into play.

What does BSB mean?

BSB stands for Bank-State-Branch, and it is a unique identifier assigned to each branch of a bank in Australia. This unique code helps in ensuring the security of transactions by providing a way to identify the exact branch involved in a particular transaction. It helps prevent fraudulent activities and ensure that the funds are being transferred to the correct recipient.

Enhanced Security: BSB codes serve as an additional layer of security by providing a way to verify the authenticity of transactions. By using the BSB code, banks can easily identify the branch involved, which helps in reducing the risk of unauthorized access or tampering.

Fraud Prevention: BSB codes play a crucial role in preventing fraud and scams. They ensure that the funds are transferred to the correct branch and recipient, minimizing the risk of fraudulent transfers. By verifying the BSB code, banks can ensure that the transaction is legitimate and reduce the chances of falling victim to fraudulent activities.

Final Thoughts: BSB codes are an essential part of the banking system in Australia, providing enhanced security and fraud prevention measures. By implementing these unique codes, banks can ensure the safety of their customers’ funds and prevent unauthorized access. It is crucial for individuals and businesses to be aware of the importance of BSB codes and ensure that they use them correctly in their banking transactions to ensure secure and legitimate transfers.

Simplified Transaction Processing

What is simplified transaction processing and how does it relate to BSB? In the realm of banking and financial institutions, transaction processing refers to the handling of financial transactions, such as payments, transfers, and withdrawals, between different accounts. Traditional transaction processing systems are complex and often require multiple steps, verification processes, and manual interventions, leading to potential delays and errors in the processing of transactions.

BSB (Bank State Branch) is an Australian banking code that identifies individual bank branches. It is used primarily for domestic money transfers and electronic transactions within the country. BSB codes play a crucial role in ensuring accurate and efficient transaction processing by directing the funds to the correct bank branch.

With the advancement of technology and the introduction of innovative solutions, simplified transaction processing techniques have emerged to streamline the entire process. These techniques aim to simplify and automate various steps involved in transaction processing, reducing the time, effort, and errors associated with manual intervention.

BSB codes are an integral part of simplified transaction processing as they help in the identification and routing of funds to the intended bank branch. By incorporating BSB codes into automated systems, financial institutions can ensure faster and more accurate transaction processing.

One of the key advantages of simplified transaction processing is the improved speed and efficiency in processing transactions. By eliminating manual steps and automating the process, transactions can be completed in a shorter timeframe, leading to enhanced customer satisfaction and reduced operational costs for banks.

Additionally, simplified transaction processing systems often come with built-in error detection mechanisms, reducing the chances of processing errors or incorrect routing of funds. This further contributes to increased accuracy and reliability in banking transactions.

In conclusion, simplified transaction processing is a modern approach to handling financial transactions, aimed at reducing complexity, improving speed, and enhancing accuracy. BSB codes are an essential element in this process, facilitating efficient routing of funds and ensuring seamless transaction processing within the Australian banking system.

Section 4: Future Trends and Developments in BSB

In the rapidly evolving world of banking and finance, it is crucial to stay up to date with the latest trends and developments in the field. This is particularly true for the concept of BSB, which stands for Bank State Branch. This term refers to a unique identifier used in some countries, such as Australia, to designate individual bank branches. But what does the future hold for BSB?

One possible future trend in BSB is the adoption of new technologies and digital banking solutions. With the increasing popularity of online banking and mobile apps, it is likely that BSB codes will become more integrated into these platforms. This could mean that customers can easily access their BSB information through their banking app, simplifying the process of making transactions and managing accounts.

Another future development in BSB could be the standardization of codes across different countries. Currently, BSB codes vary from country to country, making it challenging for international transactions. However, there is a growing need for a universal system that can facilitate global financial transactions. Implementing a standardized BSB system could potentially solve this issue and streamline cross-border banking.

The future of BSB also holds the potential for increased security measures. As cyber threats continue to evolve, banks are constantly looking for ways to protect their customers’ information and prevent fraud. In the future, BSB codes may be enhanced with additional security features, such as biometric authentication or encryption, to ensure the safety of financial transactions.

In conclusion, the future of BSB is likely to be shaped by advancements in technology, the need for international standardization, and the importance of security. These factors will undoubtedly influence the way BSB codes are used and implemented in the coming years. As the banking industry continues to evolve, it will be interesting to see how BSB adapts and transforms to meet the changing needs of customers and the global financial landscape.

Integration with Emerging Technologies

With the rapid advancement of technology, businesses are constantly striving to stay ahead of the competition by integrating emerging technologies into their operations. One such technology is BSB, which stands for Business Services Bus. But what does BSB mean and how does it fit into the integration landscape?

BSB is a concept that allows businesses to connect their various systems and applications in a unified and seamless manner. It provides a standardized way of communication between different software components, making it easier for businesses to integrate new technologies such as artificial intelligence, machine learning, and blockchain.

By leveraging BSB, businesses can streamline their operations, improve efficiency, and enhance their customer experience. For example, through the integration of AI technologies, businesses can automate repetitive tasks, analyze large amounts of data, and provide personalized recommendations to customers.

BSB also enables businesses to easily adopt and scale emerging technologies. It acts as a bridge between the existing systems and the new technologies, allowing businesses to gradually integrate and test these technologies without disrupting their current operations.

Benefits of integrating BSB with emerging technologies:

- Improved efficiency: By automating tasks and streamlining processes, businesses can reduce manual errors and improve overall efficiency.

- Enhanced customer experience: With the help of AI and machine learning, businesses can provide personalized recommendations, improve customer support, and deliver a seamless user experience.

- Increased competitiveness: By staying abreast of the latest technologies and integrating them into their operations, businesses can gain a competitive edge over their rivals.

- Future-proofing: Integrating BSB with emerging technologies ensures that businesses are well-prepared for the future and can easily adapt to new advancements.

In conclusion, BSB provides businesses with a means to integrate emerging technologies into their operations, improving efficiency, enhancing customer experience, and future-proofing their operations. By leveraging BSB, businesses can stay ahead of the game and take full advantage of the benefits offered by emerging technologies.

Expansion of BSB Applications

The abbreviation BSB stands for Bank State Branch. It is a unique identifier used by financial institutions in Australia to process domestic funds transfers. BSB is a six-digit number that is assigned to each individual bank branch within Australia. Previously, its primary use was limited to facilitating electronic funds transfers, but nowadays, the applications of BSB have expanded significantly.

One of the key areas where BSB is used is in online banking. When setting up a new bank account or making a transfer online, individuals are often required to input the BSB number of the recipient. This ensures that the funds reach the correct branch and account. Without the accurate BSB, there can be delays or even errors in the transaction, leading to inconvenience for both parties involved.

Additionally, BSB is also employed in other financial services, such as direct debit and direct credit. These services enable individuals and businesses to automate their payment processes, allowing regular transfers from one account to another. By including the BSB number, the system can accurately identify the recipient’s branch and route the funds accordingly, saving time and effort for all parties.

Furthermore, the expansion of BSB applications has led to increased convenience in the identification and verification of bank accounts. For instance, when setting up recurring bill payments, individuals can provide their BSB number along with their account number. This combination of details ensures that the correct account is debited for the payment, reducing the risk of errors and simplifying the bill payment process.

To summarize, BSB, which stands for Bank State Branch, has expanded its applications beyond electronic funds transfers. It is now an integral part of online banking, direct debit and direct credit services, and account identification. By accurately providing the BSB number, individuals and businesses can ensure that their financial transactions are processed smoothly and efficiently.

Potential Challenges and Solutions

Challenge: Not understanding what BSB means

When confronted with the acronym BSB, it is natural to wonder what it means. BSB stands for Bank State Branch, which is a unique identifier used in the banking system of Australia to determine the specific bank and branch associated with an account. This can be confusing for individuals who are not familiar with the Australian banking system.

Solution: Researching and learning about BSB

To overcome this challenge, individuals can take the initiative to research and learn about BSB. They can start by reading articles or watching videos that explain the concept. Additionally, they can reach out to Australian banking institutions for further clarification and guidance.

Challenge: Difficulty in finding the BSB number

Locating the BSB number for a specific bank or branch can be a challenge for individuals who are not accustomed to navigating the Australian banking system. This can cause frustration and delay in completing banking transactions.

Solution: Utilizing online resources and contacting the bank

To address this challenge, individuals can utilize online resources such as official bank websites or financial directories that provide BSB numbers. These resources often provide search functions that allow users to find the BSB number based on the bank name and location. If the BSB number cannot be found online, individuals can contact the bank directly for assistance.

FAQ about topic “What Does BSB Mean? Find Out Everything Here”

What is the full form of BSB?

The full form of BSB is Backstreet Boys. It is a popular American boy band that gained worldwide fame in the 1990s.

How many members are there in BSB?

BSB originally had five members: Nick Carter, Howie Dorough, Brian Littrell, AJ McLean, and Kevin Richardson. However, Kevin Richardson left the group in 2006 but rejoined in 2012.

What are some of the popular songs of BSB?

Some of the popular songs of BSB include “I Want It That Way,” “Everybody (Backstreet’s Back),” “As Long As You Love Me,” “Quit Playing Games (With My Heart),” and “Shape of My Heart.”

When did BSB release their debut album?

BSB released their debut album, titled “Backstreet Boys,” in the United States on May 6, 1997. It went on to become a huge success, selling over 14 million copies worldwide.

What is the history of BSB?

The history of BSB dates back to 1993 when Lou Pearlman formed a boy band called the Backstreet Boys in Orlando, Florida. They started gaining popularity in Europe before eventually achieving worldwide success. They have released numerous albums, gone on several tours, and have won several awards.