XBRL, also known as eXtensible Business Reporting Language, is a standardized format for digital business and financial reporting. It revolutionizes the way businesses and organizations communicate their financial and non-financial information, providing a reliable and efficient method for analysis, decision-making, and regulatory compliance.

XBRL was developed in response to the increasing demand for a standardized language that could improve the efficiency and accuracy of financial reporting. The traditional methods of reporting, involving manual data entry and formatting, were prone to errors and misinterpretations. With XBRL, businesses can now electronically tag their financial data with standardized, machine-readable labels known as taxonomy, allowing for easier data collection, analysis, and comparison.

The benefits of using XBRL are numerous. Firstly, it facilitates the analysis and comparison of business and financial data, as it provides a common language for communication. This allows investors, analysts, and regulators to easily understand and interpret the information, leading to better decision-making and investment strategies.

Additionally, XBRL enables interoperability between different accounting software systems, making it easier to exchange financial data between organizations. This streamlines the reporting process, reduces administrative costs, and ensures accuracy and consistency of data across different platforms.

Furthermore, the regulatory environment has embraced XBRL as a means to improve transparency and standardization in financial reporting. Many countries and regulatory bodies now require businesses, particularly publicly traded companies, to submit their financial statements in XBRL format. This not only simplifies the reporting process for businesses, but also enhances the reliability and accessibility of financial information for regulators, investors, and the market.

In conclusion, XBRL is a technology-driven language that has revolutionized the way businesses communicate their financial and non-financial information. Its standardized format, interoperability, and regulatory compliance make it an essential tool in the digital age of business and accounting. With the use of XBRL, businesses can streamline their reporting processes, enhance analysis and decision-making, and contribute to a more transparent and efficient market.

Contents

- 1 Definition and Purpose

- 2 History of XBRL

- 3 Advantages of XBRL

- 4 XBRL Applications

- 5 FAQ about topic “What is XBRL: Exploring the Benefits and Applications of eXtensible Business Reporting Language”

- 6 What is XBRL?

- 7 How does XBRL benefit businesses?

- 8 Is XBRL widely adopted?

- 9 What are the applications of XBRL?

- 10 Are there any challenges in implementing XBRL?

Definition and Purpose

The eXtensible Business Reporting Language (XBRL) is a market-leading technology for the formatting and communication of business and financial information. It is an open, global standard that enables the digital reporting of financial data in a structured and standardized format.

The main purpose of XBRL is to improve the efficiency, accuracy, and interoperability of business reporting. It provides a standardized language and taxonomy for classifying and tagging financial data, making it easier for businesses, regulators, and investors to analyze and compare financial information.

XBRL allows financial information to be expressed in a machine-readable format, which enables automated data collection, validation, and analysis. It eliminates the need for manual data entry and reduces the risk of errors in financial reporting. By leveraging XBRL, businesses can streamline their reporting processes and improve the quality and timeliness of their financial information.

Furthermore, XBRL enables seamless integration with other software applications and systems, facilitating the exchange and analysis of financial data across different platforms. It promotes the sharing and reusability of financial information, making it easier for businesses to collaborate and for regulators to monitor compliance.

In summary, XBRL is a powerful tool for digital reporting and information exchange in the business and accounting world. Its standardized format and taxonomy enhance the accuracy, efficiency, and interoperability of financial reporting, benefiting businesses, regulators, and investors alike.

History of XBRL

XBRL (eXtensible Business Reporting Language) was developed in the late 1990s as a digital format for exchanging financial and business data. It was created to address the inefficiencies in the traditional paper-based reporting process and provide a standardized method for representing financial information.

The idea of using a standardized language for reporting financial data was first proposed by Charles Hoffman, a CPA and technologist. In 1998, he formed a consortium of companies, government agencies, and accounting organizations with the goal of developing a universal format for business reporting. This consortium later became the XBRL International, a global standard-setting body.

The XBRL language is based on XML (eXtensible Markup Language), a technology that allows for the exchange of structured data over the internet. XBRL introduced a standardized taxonomy, which is a classification system for financial reporting elements. This taxonomy provides a standardized set of tags and definitions for various financial concepts, such as revenues, expenses, assets, and liabilities.

With the introduction of XBRL, financial reporting has become more efficient and accurate. Companies can now create a single XBRL document that can be used for reporting to multiple regulators, investors, and other stakeholders. XBRL allows for the seamless communication and interoperability of financial data across different software applications and platforms, eliminating the need for manual data entry and formatting.

The use of XBRL has been widely adopted in the financial market and regulatory bodies around the world. It has become a standard for financial reporting in many countries, including the United States, the European Union, and Japan. XBRL has also gained popularity in other sectors, such as corporate reporting, business analytics, and data analysis.

Advantages of XBRL

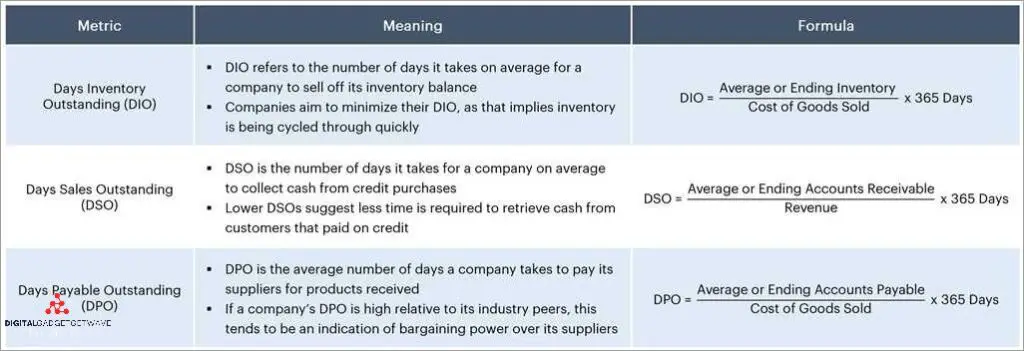

Market Data and Analysis: XBRL allows for efficient processing and analysis of financial data. With XBRL, market participants can access standardized financial information, leading to improved data comparison, analysis, and decision-making in the marketplace.

Formatting and Structure: XBRL provides a standardized format for financial statements and other business reports. This makes it easier to organize and present data in a consistent and structured manner, ensuring clarity and accuracy in financial reporting.

Interoperability and Integration: XBRL enables seamless integration and sharing of financial information across different software platforms and systems. This promotes interoperability between different applications and simplifies data exchange, improving efficiency and reducing errors in financial communication.

Digital Regulatory Reporting: XBRL simplifies regulatory reporting by providing a common language and format for submitting financial information to regulators. This streamlines the reporting process, reduces the burden on businesses, and improves the accuracy and consistency of regulatory filings.

Effective Accounting and Analysis: XBRL enhances the accuracy and reliability of accounting and financial analysis. It enables automatic validation and verification of data, reducing the risk of errors and ensuring the integrity of financial information.

Standardized Taxonomy: XBRL relies on a standardized taxonomy, which defines the elements and relationships within financial reports. This ensures that financial information is uniformly structured and categorized, facilitating accurate analysis and comparison across different companies and industries.

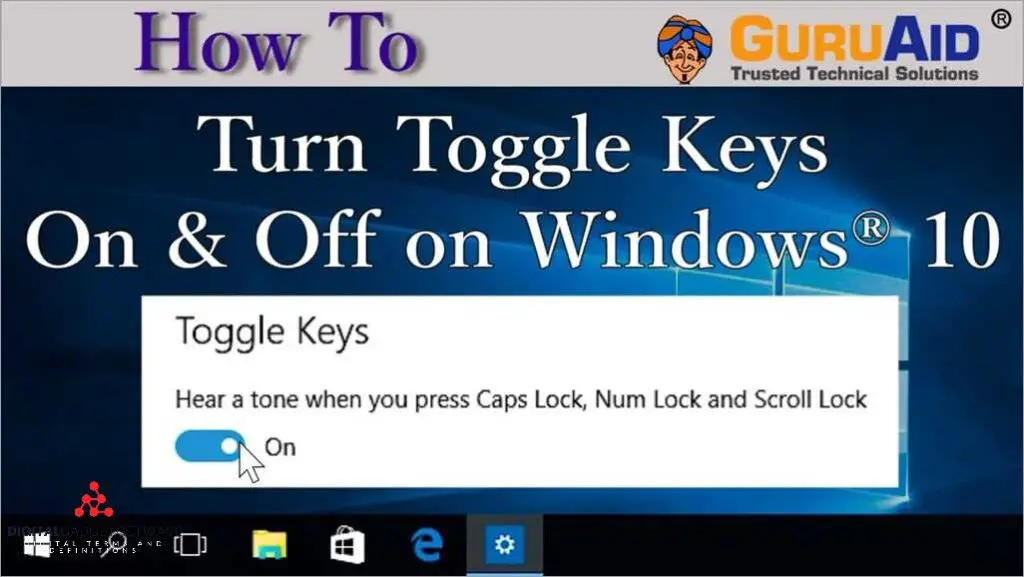

Efficient Software Implementation: XBRL is supported by various software applications and tools specifically designed for financial reporting. This makes it easier for businesses to implement XBRL and integrate it into their existing accounting systems, saving time and resources in the process.

Improved Financial Communication: XBRL enhances the transparency and clarity of financial communication between businesses, investors, analysts, and regulators. It enables efficient exchange of financial information, reducing misunderstandings and facilitating informed decision-making.

Streamlined Document Management: XBRL simplifies the management of financial documents by providing a standardized and electronic format. This eliminates the need for manual data entry and reduces the risk of document loss or damage, improving the efficiency and security of financial document storage and retrieval.

Improved Data Accuracy

The use of eXtensible Business Reporting Language (XBRL) improves data accuracy by digitizing financial and other business information. When information is in a digital format, it can be easily analyzed using software and formatting tools, reducing the risk of human error in the data entry process.

XBRL provides a standardized system for accounting and financial reporting, which ensures that data is consistently formatted and labeled. This makes it easier to compare and analyze data from different organizations, allowing for more accurate financial analysis and market research.

The use of a standardized XBRL taxonomy also improves data accuracy by ensuring that the same financial terms and concepts are used across different reporting documents. This promotes consistency and eliminates ambiguity in financial reporting, reducing the risk of misinterpretation or misunderstanding.

Furthermore, XBRL enables seamless communication and interoperability between different software systems and platforms. This eliminates the need for manual data entry and reduces the risk of data transcription errors. By using a common language and format, XBRL facilitates the automatic transfer of financial data between different systems, improving data accuracy and efficiency.

In summary, the use of XBRL technology in financial and business reporting improves data accuracy by digitizing and standardizing information, promoting consistency and eliminating human error. It facilitates more accurate analysis of financial information, enhances market research, and promotes better decision-making in the business and regulatory environments.

Cost and Time Savings

The use of XBRL brings significant cost and time savings in financial reporting and analysis. By adopting this digital language, businesses can streamline their reporting processes and eliminate the need for manual data entry. XBRL enables interoperability between different accounting software systems, allowing seamless transfer of financial information without the need for reformatting or data conversion.

XBRL’s standardized format ensures that all data is consistently presented and easily searchable. This not only improves the accuracy and reliability of financial information but also enhances the efficiency of data analysis. With XBRL, analyzing large volumes of financial data becomes faster and more insightful, enabling businesses to make informed decisions and identify trends and patterns in the market.

Another significant advantage of XBRL is its ability to simplify reporting for regulatory bodies. By adopting the XBRL taxonomy, businesses can easily comply with reporting requirements imposed by regulatory authorities. The use of XBRL reduces the time and effort required to produce accurate and comprehensive financial reports, ensuring compliance while saving costs on expensive regulatory filings.

The adoption of XBRL also simplifies the communication of financial information between business partners. With XBRL, businesses can easily generate and exchange financial reports in a standardized digital format, eliminating the need for printing and mailing paper documents. This not only saves costs associated with printing and postage but also reduces the time and effort required for manual document handling and processing.

To fully leverage the benefits of XBRL, businesses can utilize specialized XBRL software to automate the preparation, validation, and submission of financial reports. This software simplifies and accelerates the reporting process, saving businesses valuable time that can be allocated to other critical tasks. With the automation provided by XBRL technology, businesses can achieve significant cost savings by reducing manual errors and improving the overall efficiency of their reporting systems.

Enhanced Analysis and Comparability

The use of XBRL enables enhanced analysis and comparability of financial data. By standardizing the format and structure of financial reports, XBRL allows for easy comparison of data across different companies and industries. This is particularly valuable for investors and analysts who need to quickly gather and compare information from multiple sources.

The XBRL taxonomy, which serves as a dictionary of accounting concepts, provides a standardized set of terms and definitions that businesses can use to tag their financial information. This ensures that similar data elements are consistently identified and allows for more accurate analysis and comparison.

In addition, XBRL enables the integration of financial data into various software applications. XBRL-compatible software can automatically extract and analyze financial information, eliminating the need for manual data entry and reducing the risk of errors. This automation streamlines the analysis process, allowing users to quickly identify trends, outliers, and anomalies in the data.

XBRL’s ability to facilitate the exchange of financial information in a digital format also improves the interoperability and communication between different stakeholders. Regulatory bodies can easily collect and analyze financial data from multiple entities, enhancing their ability to monitor and enforce compliance with financial regulations.

Furthermore, XBRL’s formatting capabilities enable the presentation of financial data in a standardized and visually appealing manner. This enhances the readability and comprehension of financial reports, making it easier for users to interpret and analyze the information. With XBRL, businesses can present their financial data in a consistent format, improving transparency and facilitating meaningful comparisons between different reporting periods.

In summary, the adoption of XBRL as a standard technology for financial reporting brings numerous benefits, including enhanced analysis and comparability of financial data. By providing a standardized format, taxonomy, and software integration, XBRL enables efficient data analysis, improved communication, and reliable financial reporting.

XBRL Applications

XBRL, or eXtensible Business Reporting Language, has a vast range of applications in the business and financial sectors. This digital language is designed for the efficient communication of financial and accounting data.

One of the key applications of XBRL is financial reporting. Companies can use XBRL to standardize their financial statements and reports, making them easier to analyze and compare. The use of XBRL allows for greater interoperability between different software systems, enabling seamless exchange of financial information.

With XBRL, regulatory bodies can benefit from a standardized format for receiving financial data from businesses. This not only simplifies the reporting process but also facilitates faster and more accurate analysis of the reported information.

The use of XBRL in financial analysis helps professionals efficiently analyze the financial performance of businesses. XBRL allows for easier comparisons and benchmarking between companies, market segments, and industries. It simplifies data analysis and reduces the manual effort involved in collecting and formatting financial information.

XBRL also plays a crucial role in regulatory compliance. The use of a standardized taxonomy in XBRL ensures that financial information is reported in a consistent and structured manner. This standardization makes it easier for regulatory authorities to analyze data, identify trends, and detect anomalies. Additionally, XBRL improves the transparency and reliability of financial reporting.

The market for XBRL software and technology solutions is growing rapidly as more businesses and regulatory bodies recognize the benefits of using this standardized language. Companies can find XBRL software that supports the creation and analysis of financial reports, while regulators can access specialized tools for data validation and compliance monitoring.

Overall, the application of XBRL in the business and financial environment has transformed the way information is reported, analyzed, and communicated. This standardized language has paved the way for increased efficiency, accuracy, and transparency in financial reporting, benefiting businesses, regulators, and investors alike.

Financial Reporting

Financial reporting is the process of creating and presenting financial information in a standardized format. It involves the analysis, documentation, and formatting of data related to a business’s financial performance. Through the use of digital software and technology, financial reporting allows for efficient communication of financial information.

The regulatory requirements for financial reporting necessitate the use of standard formats such as XBRL (eXtensible Business Reporting Language). This language facilitates the interoperability and exchange of financial data across different accounting and reporting systems. By standardizing the format, XBRL enables accurate and reliable analysis of financial information, enhancing transparency and comparability in the market.

Financial reporting plays a crucial role in providing stakeholders with essential information about a business’s financial health and performance. It enables investors, creditors, and other interested parties to assess the company’s profitability, liquidity, and solvency. By presenting financial information in a standardized format, financial reporting enhances decision-making processes and ensures accountability in business operations.

Overall, financial reporting is a vital component of the business world, serving as a means to communicate financial information accurately, efficiently, and transparently. The use of technologies, such as XBRL, helps streamline the reporting process and enables businesses to meet regulatory requirements while providing valuable insights for informed decision-making.

Regulatory Reporting

Regulatory reporting is the process of providing data to regulatory authorities in a standardized format. It involves the collection, analysis, and communication of financial and accounting information to comply with regulatory requirements. The use of digital technology and the eXtensible Business Reporting Language (XBRL) provides a standardized format for regulatory reporting.

The XBRL taxonomy is a set of standardized tags that define the data elements used in financial reporting. It allows for consistent and standardized formatting of financial information, making it easier for regulatory authorities to analyze and compare data across different entities. The use of XBRL eliminates the need for manual data entry and reduces the risk of errors in regulatory reporting.

The digital format of regulatory reporting enables efficient data analysis by regulatory authorities. They can use software tools to automatically analyze vast amounts of data, identify trends, and detect anomalies. This improves the effectiveness and accuracy of regulatory oversight, helping to identify potential risks in the market and take appropriate actions.

Regulatory reporting also benefits businesses by streamlining the reporting process. The use of XBRL standardizes the format of financial information, making it easier for organizations to prepare and submit regulatory reports. It reduces the time and effort required for manual data preparation and formatting, allowing companies to focus on their core operations.

Furthermore, the use of XBRL in regulatory reporting enhances transparency and comparability in the market. Standardized financial information enables stakeholders to easily understand and compare the performance of different businesses. This promotes a level playing field and facilitates informed decision-making by investors, analysts, and other market participants.

In summary, regulatory reporting in the digital age leverages XBRL and standardized formats to streamline the reporting process, improve data analysis, and enhance transparency in the business and financial market. It is an essential component of regulatory oversight and ensures compliance with regulatory requirements.

Business Intelligence

Business Intelligence (BI) is a digital technology that involves the analysis and presentation of information for decision-making purposes. It encompasses various methods, processes, and software tools that assist organizations in gathering, storing, analyzing, and accessing data to gain insights into their operations and improve performance.

One crucial aspect of BI is the use of standard formats and taxonomies to ensure the interoperability and consistency of data. This is where XBRL (eXtensible Business Reporting Language) comes into play. XBRL is a standardized communication format specifically designed for accounting and financial reporting. It allows for the digital formatting and tagging of data, making it easier to analyze and compare information across different companies and sectors.

The use of XBRL in business intelligence enables efficient data integration and reporting. It provides a structured and standardized means of collecting and sharing financial information, facilitating the analysis of market trends, investment opportunities, and regulatory compliance.

By adopting XBRL as a reporting standard, organizations can streamline their data collection and reporting processes. XBRL-compatible software tools can automatically extract relevant data from financial statements and convert it into a structured format. This not only saves time but also reduces the risk of errors and inconsistencies in reporting.

Furthermore, XBRL enables the seamless exchange of financial information between different systems and platforms. It improves data accuracy and enhances the overall efficiency of financial reporting processes.

In summary, incorporating XBRL into business intelligence practices can greatly enhance the capabilities of organizations to analyze and utilize financial data. It ensures the standardization and accuracy of financial reporting, enhances regulatory compliance, and facilitates interoperability and communication in the business ecosystem.

FAQ about topic “What is XBRL: Exploring the Benefits and Applications of eXtensible Business Reporting Language”

What is XBRL?

XBRL stands for eXtensible Business Reporting Language. It is a standardized format for exchanging business and financial information between different software systems. XBRL allows users to electronically capture, analyze, and exchange data in a more efficient and accurate way.

How does XBRL benefit businesses?

XBRL provides several benefits for businesses. Firstly, it streamlines the reporting process by automating the conversion of financial data into a standardized format, reducing the risk of errors and saving time and resources. Secondly, it allows for easier comparison and analysis of financial information, enabling investors, analysts, and regulators to make more informed decisions. Lastly, XBRL improves transparency and accountability by making financial reports more accessible and understandable to stakeholders.

Is XBRL widely adopted?

Yes, XBRL is widely adopted by regulatory bodies, businesses, and financial institutions worldwide. Many countries have implemented XBRL as a standard for financial reporting and data exchange. Additionally, major stock exchanges and regulatory agencies require companies to submit their financial statements in XBRL format.

What are the applications of XBRL?

XBRL has various applications in the business and financial sectors. It is commonly used for financial reporting, including the preparation and submission of financial statements to regulatory bodies. XBRL is also used for data analysis and benchmarking, as it allows for easy comparison and aggregation of financial data from different sources. Furthermore, XBRL is used for financial data integration, facilitating the exchange of information between different systems and software applications.

Are there any challenges in implementing XBRL?

While XBRL offers numerous benefits, there are challenges in implementing it. One challenge is the complexity of the XBRL taxonomy, which defines the structure and elements of the reporting format. Creating and maintaining a comprehensive and accurate taxonomy can require significant effort and expertise. Additionally, training and educating stakeholders on XBRL may be necessary to ensure proper understanding and compliance. Furthermore, the compatibility and interoperability of different software systems can pose challenges in data exchange and integration.