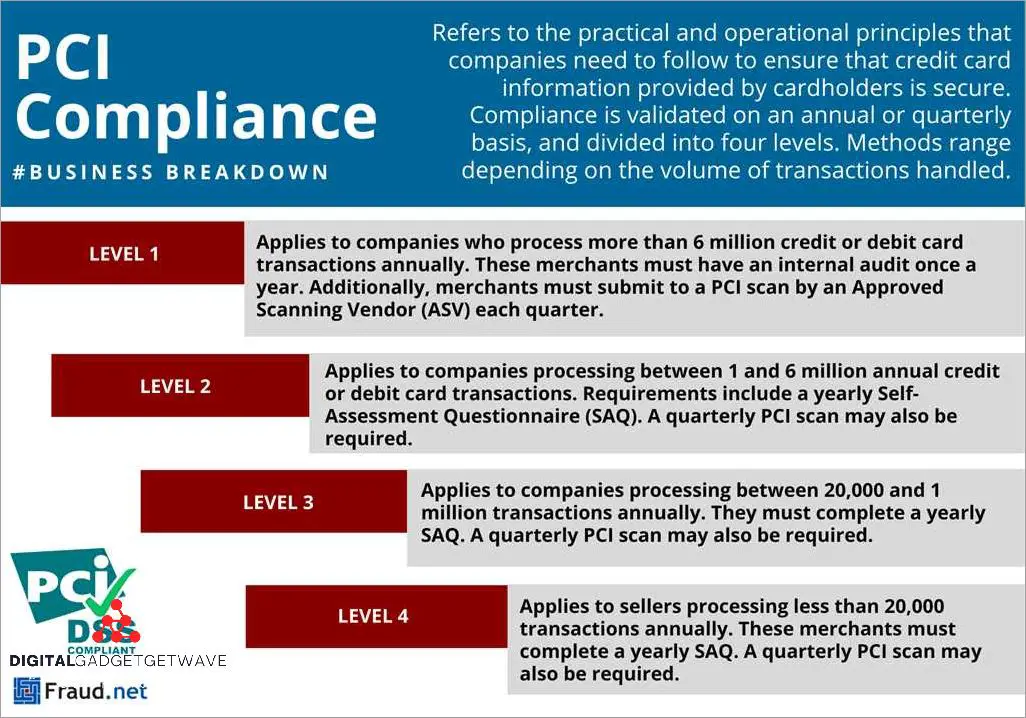

PCI Compliance Auditing refers to the process of assessing an organization’s adherence to the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS is a set of controls and policies designed to protect cardholder data and ensure the secure handling of payment transactions. Auditing plays a crucial role in ensuring that organizations are compliant with these standards and are effectively mitigating the risk of data breaches.

During a PCI Compliance Audit, an independent auditor evaluates an organization’s network, systems, and processes to identify potential vulnerabilities and assess the effectiveness of their security controls. This assessment involves conducting thorough vulnerability scans, reviewing policies and procedures, and testing the security of payment card data storage and transmission.

By conducting regular PCI Compliance Audits, organizations can identify and address any weaknesses in their security measures before they are exploited by cybercriminals. These audits help organizations stay up to date with the latest technologies and security practices, ensuring that they remain compliant with industry regulations.

PCI Compliance Auditing plays a critical role in data security as it helps organizations identify and rectify any gaps in their security controls that could potentially lead to data breaches. By undergoing regular assessments, organizations can proactively identify and resolve vulnerabilities, protecting sensitive payment card data from unauthorized access or disclosure. Additionally, the certification obtained through PCI Compliance Auditing instills trust and confidence in customers, as it demonstrates an organization’s commitment to data security and compliance with industry standards.

Contents

- 1 What is PCI Compliance Auditing?

- 2 Definition and Importance

- 3 How Does PCI Compliance Auditing Work?

- 4 Process and Steps

- 5 Why is PCI Compliance Auditing Important for Data Security?

- 6 Protection and Vulnerability

- 7 Best Practices for PCI Compliance Auditing

- 8 Tips and Guidelines

- 9 FAQ about topic “Understanding PCI Compliance Auditing for Securing Data”

- 10 What is PCI compliance auditing?

- 11 Why is PCI compliance auditing important for data security?

- 12 What are the consequences of non-compliance with PCI DSS?

- 13

- 14 Who is responsible for PCI compliance auditing?

What is PCI Compliance Auditing?

PCI Compliance Auditing is a crucial component of ensuring data security in the payment industry. PCI stands for Payment Card Industry, and compliance refers to adhering to specific regulations and policies set forth by the industry to protect sensitive payment card data.

Payment card data is highly valuable and attracts a significant amount of risk. To mitigate this risk, the PCI Data Security Standard (PCI DSS) was established, which outlines a set of security controls and requirements that organizations must implement to protect payment data. Compliance with this standard is necessary for any company that handles or processes payment card data.

PCI Compliance Auditing involves conducting an assessment and audit of an organization’s network, systems, and processes to ensure they are compliant with the PCI DSS. This auditing process helps identify any vulnerabilities or weaknesses that could potentially lead to a data breach.

During the audit, a qualified auditor reviews the organization’s security measures, policies, and procedures, both from a technical and administrative standpoint. This includes evaluating the network architecture, access controls, encryption methods, and employee training programs. The auditor also examines records and documentation to verify compliance.

By conducting regular PCI Compliance Audits, organizations can identify areas of non-compliance and take corrective actions to become compliant. This helps to safeguard sensitive payment card data, maintain customer trust, and reduce the risk of a costly data breach. Overall, PCI Compliance Auditing plays a vital role in ensuring the security of the payment industry and fostering a culture of compliance within the technology and industry.

Definition and Importance

PCI compliance auditing is the process of evaluating and assessing an organization’s adherence to the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS is a set of security regulations and controls designed to protect the data of payment cardholders and reduce the risk of data breaches and fraud. Compliance with the standards is crucial for any organization that handles, processes, or stores payment card data.

The main purpose of PCI compliance auditing is to ensure that organizations have implemented the necessary security measures and controls to protect sensitive cardholder data. This includes assessing vulnerabilities, reviewing security policies and procedures, and conducting network and system scans to identify any potential risks or weaknesses.

Compliance with PCI DSS is not only important for protecting customer data, but also for meeting legal and industry requirements. Failure to comply with PCI DSS regulations can result in significant penalties, fines, and even the loss of ability to process credit card payments. Therefore, regular PCI compliance audits are essential to maintaining a secure environment and demonstrating adherence to the industry standards.

PCI compliance auditing involves various steps, such as conducting an assessment of security controls, reviewing documentation and processes, examining network configurations, and performing vulnerability scans. These audits help organizations identify areas of non-compliance and take necessary actions to rectify them, enhancing data security and reducing the risk of potential breaches.

In conclusion, PCI compliance auditing plays a crucial role in ensuring the security of payment card data. By achieving and maintaining PCI compliance certification, organizations can protect sensitive data, reduce the risk of security breaches, and build trust with customers and partners in the industry. Regular audits help organizations stay up-to-date with evolving security standards and ensure ongoing compliance, ultimately safeguarding the integrity and confidentiality of cardholder information.

Explanation of PCI Compliance Auditing

PCI compliance auditing is a crucial process in the payment card industry that helps protect sensitive data and ensure the security of payment transactions. It involves the evaluation and assessment of an organization’s network, systems, and controls to identify any vulnerability or risk that may lead to a data breach.

During a PCI compliance audit, the organization’s policies, procedures, and technology are thoroughly examined to ensure they align with the industry regulation, known as the Payment Card Industry Data Security Standard (PCI DSS). This comprehensive set of security requirements is designed to protect cardholder data and maintain the integrity of the payment card ecosystem.

The process of PCI compliance auditing involves performing a risk assessment to identify potential security gaps and vulnerabilities. This assessment evaluates the organization’s network infrastructure, security controls, access management, and data handling procedures. It also includes examining the organization’s technology systems and processes, such as encryption methods, firewall configurations, and intrusion detection systems.

Through the audit, organizations can identify areas that need improvement and implement the necessary controls and measures to address any deficiencies. This helps ensure that sensitive data is handled and stored securely, reducing the risk of a data breach. In addition, PCI compliance auditing provides organizations with a certification to demonstrate their commitment to data security and meet the industry standards.

Overall, PCI compliance auditing plays a vital role in protecting payment card data and maintaining the integrity of the payment card industry. By adhering to the PCI DSS and regularly undergoing audits, organizations can ensure the security of their systems, maintain customer trust, and avoid potential financial and reputational damages associated with data breaches.

Significance of PCI Compliance Auditing

PCI Compliance Auditing plays a vital role in the technology industry as it helps to protect sensitive data and ensure secure payment transactions. With the constant threat of cyberattacks and data breaches, it is crucial for organizations to maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS).

An audit is conducted to assess an organization’s compliance with the PCI DSS requirements and determine if they are implementing the necessary controls to protect cardholder data. It involves a comprehensive assessment of an organization’s security policies, procedures, network infrastructure, and payment processing systems.

PCI compliance auditing helps organizations identify security vulnerabilities and address them promptly. By conducting regular audits, organizations can ensure that they are following the necessary regulations and standards to maintain a secure network environment. This includes implementing robust security measures, such as encryption, firewalls, and intrusion detection systems.

Auditing also helps organizations identify and mitigate potential risks associated with data breaches and fraud. By evaluating their compliance with the PCI DSS requirements, organizations can identify areas of improvement and implement necessary controls to mitigate vulnerabilities.

Obtaining PCI compliance certification is essential for organizations in the payment industry as it demonstrates their commitment to data security and compliance. It helps build trust among customers and partners, assuring them that their payment information is handled securely.

In conclusion, PCI compliance auditing is of utmost importance in today’s industry to ensure data security and protect against potential cyber threats. It helps organizations assess their compliance with regulations, identify vulnerabilities, and implement necessary controls to maintain a secure network environment for payment transactions.

How Does PCI Compliance Auditing Work?

PCI Compliance Auditing is a process that ensures the security of payment card data. It involves the assessment of an organization’s compliance with the Payment Card Industry Data Security Standard (PCI DSS), a set of requirements designed to protect cardholder data.

During a PCI Compliance Audit, a certified auditor examines the organization’s policies, procedures, and controls related to the storage, processing, and transmission of cardholder data. The auditor also assesses the organization’s network architecture, software configurations, and physical security measures to identify any vulnerabilities that could be exploited by attackers.

The auditing process typically involves several steps. First, the auditor reviews documentation, including policies, procedures, and evidence of implementation, to determine the organization’s level of compliance. This may include reviewing the results of vulnerability assessments and penetration testing.

Next, the auditor conducts interviews with key personnel to gain a deeper understanding of the organization’s security practices and controls. They may also perform on-site visits to inspect physical security measures and observe data handling processes.

Once the auditing process is complete, the auditor prepares a report detailing the organization’s level of compliance with the PCI DSS. This report includes any findings of non-compliance and recommendations for remediation.

PCI Compliance Auditing plays a crucial role in ensuring the security of payment card data. By conducting regular audits, organizations can identify and address vulnerabilities before they can be exploited, reducing the risk of a data breach. In addition, compliance with the PCI DSS helps organizations demonstrate their commitment to data security and build trust with customers in the payment industry.

Process and Steps

PCI compliance auditing is a crucial process for organizations that handle payment card data. It involves conducting regular assessments to ensure that the organization is adhering to the Payment Card Industry Data Security Standard (PCI DSS). The purpose of the auditing process is to identify any vulnerabilities or gaps in compliance with the standard and take appropriate measures to address them.

The first step in the auditing process is to define the scope. This involves identifying all the systems, processes, and networks that are involved in the handling of payment card data. Once the scope is defined, a vulnerability assessment is conducted to identify any potential weaknesses or security risks. This assessment helps to determine the level of compliance and identify areas that require improvement.

The next step is to develop a remediation plan based on the findings of the vulnerability assessment. This plan outlines the steps and actions that need to be taken to address the identified vulnerabilities and bring the organization into compliance with the PCI DSS. It may involve implementing new security controls, updating policies and procedures, or enhancing the organization’s technology infrastructure.

Once the remediation plan is in place, the organization can proceed with the implementation of the necessary changes and modifications. This may involve training employees, updating software and hardware systems, and establishing new protocols and procedures. The implementation process should be carefully managed to ensure that all necessary changes are properly implemented and that the organization is fully compliant with the PCI DSS.

After the implementation is complete, a final audit is conducted to assess the effectiveness of the changes and ensure that the organization is in full compliance with the PCI DSS. This audit involves a thorough review of the organization’s systems, controls, and processes to ensure that all requirements are met. If any gaps or non-compliance issues are identified during this audit, additional remediation steps may be necessary.

It is important for organizations to regularly conduct PCI compliance audits to maintain data security and protect against potential data breaches. By following the auditing process and taking appropriate steps to address vulnerabilities and ensure compliance, organizations can minimize the risk of data loss and maintain the trust of their customers and partners in the industry.

Overview of PCI Compliance Auditing Process

The Payment Card Industry Data Security Standard (PCI DSS) is a set of controls and policies established by the payment card industry to ensure the security of payment card data. To ensure compliance with these standards, organizations undergo periodic auditing processes.

PCI compliance auditing involves an assessment of an organization’s payment card data security measures. It is conducted by qualified auditors who evaluate the organization’s controls, policies, and procedures to identify vulnerabilities and assess the level of risk.

The audit process typically begins with a review of the organization’s policies and procedures for handling payment card data. Auditors assess whether these policies align with the PCI DSS requirements and whether they effectively protect against unauthorized access or data breach.

Next, auditors perform technical assessments to evaluate the organization’s network security measures. This includes analyzing the network architecture, identifying any vulnerabilities or weaknesses, and ensuring that proper security controls are in place.

During the audit, auditors also examine the organization’s data storage and transmission practices. They assess how sensitive cardholder data is handled, whether encryption is utilized, and if secure technologies are employed to protect against unauthorized access and data breaches.

Once the auditing process is complete, the organization receives an audit report that outlines the findings and provides recommendations for improving security and achieving compliance. If all requirements are met, the organization is granted a PCI compliance certification.

PCI compliance auditing is crucial in the payment card industry as it ensures that organizations are following the necessary security measures to protect cardholder data. By undergoing regular audits, organizations can identify and address vulnerabilities, reduce the risk of data breaches, and demonstrate their commitment to maintaining industry regulations and standards.

Step-by-Step Guide to PCI Compliance Auditing

PCI compliance auditing plays a crucial role in ensuring the security of payment data in the industry. It involves a thorough audit of an organization’s policies, controls, and technology to assess its compliance with the Payment Card Industry Data Security Standard (PCI DSS).

The first step in PCI compliance auditing is to understand the requirements set forth by the PCI DSS. This involves reviewing the standard and understanding the different categories and levels of compliance that apply to an organization based on its role in processing payments.

Once familiar with the requirements, the next step is to conduct a comprehensive assessment of the organization’s network and data infrastructure. This includes identifying and addressing any vulnerabilities or weaknesses that may put payment data at risk.

During the audit, the assessor will evaluate the organization’s controls and policies relating to data security. This includes reviewing access controls, encryption methods, and incident response procedures. It also involves assessing the organization’s compliance with regulatory requirements and industry best practices.

After completing the assessment, the assessor will provide a detailed report highlighting any areas in which the organization is not compliant with the PCI DSS. This report will serve as a roadmap for the organization to improve its security controls and address any identified vulnerabilities.

Once the necessary improvements have been made, the organization can undergo a certification process to demonstrate its compliance with the PCI DSS. This involves submitting the required documentation and undergoing a final audit to ensure that all compliance requirements are met.

By following this step-by-step guide to PCI compliance auditing, organizations can protect their payment data and reduce the risk of security breaches. Compliance with the PCI DSS helps to establish trust with customers and ensures that sensitive data is handled in a secure and compliant manner.

Why is PCI Compliance Auditing Important for Data Security?

PCI Compliance Auditing plays a crucial role in ensuring data security by enforcing strict policies and procedures to protect sensitive data. With rapid advancements in technology and an increasing number of cyber threats, businesses must adhere to PCI compliance regulations to safeguard their payment systems and customer data.

Audit processes help identify vulnerabilities and weaknesses in a company’s payment network and data storage systems. By conducting regular assessments, businesses can proactively identify and address security risks, ensuring that their systems and processes are up to par with industry standards.

Compliance auditing involves thorough examination and validation of controls and security measures in place to protect payment card data. It assesses whether a business is compliant with the Payment Card Industry Data Security Standard (PCI DSS) and helps identify areas that require improvement to enhance data security.

PCI compliance auditing also plays a crucial role in obtaining PCI certification, which is essential for businesses that process payment cards. Certification demonstrates to customers and partners that a company has implemented the necessary security measures to protect their data.

By conducting regular audits, businesses can stay compliant with PCI regulations, avoiding hefty fines and penalties for non-compliance. Compliance auditing not only helps protect customer data but also safeguards a company’s reputation in the industry.

Protection and Vulnerability

Protection and vulnerability go hand in hand when it comes to data security and compliance. In today’s digital landscape, where sensitive information is constantly at risk of being compromised, organizations must have a comprehensive policy in place to protect themselves and their customers.

To ensure compliance with payment card industry (PCI) regulations, businesses must implement controls and technologies that protect against vulnerabilities. Vulnerability assessment and penetration testing are crucial components of a PCI compliance audit. During an audit, the network and systems are assessed to identify any potential weaknesses that could be exploited by attackers.

By conducting periodic audits, companies can identify vulnerabilities and take necessary steps to address them. This helps to reduce the risk of a data breach and enhances the overall security posture of the organization. Auditing also ensures that the necessary security controls are in place and functioning effectively.

PCI compliance auditing involves a thorough assessment of the organization’s data security practices. This includes evaluating the processes and technology used to handle payment card information. Audits typically involve reviewing policies, procedures, and technical controls, as well as conducting interviews with key personnel.

Companies that achieve PCI compliance certification demonstrate that they have implemented the necessary measures to protect customer data and comply with the industry’s security standards. This certification provides customers with reassurance that their payment information is being handled securely.

Overall, protection and vulnerability are critical aspects of data security and compliance. By conducting regular audits and taking appropriate actions to address any weaknesses, organizations can effectively protect their data and comply with PCI regulations.

Safeguarding Data through PCI Compliance Auditing

Payment Card Industry (PCI) compliance auditing is a crucial process for organizations that handle payment card information. The audit ensures that businesses meet the compliance standards set by the payment card industry and protect sensitive data from breach and vulnerability. Through regular audits, organizations can identify and mitigate risks and implement necessary controls to maintain the security of customer cardholder data.

A PCI compliance audit covers various aspects, including network security assessment, technology controls, and data protection policies. It evaluates if an organization’s systems and processes comply with the regulations and requirements defined by the payment card industry. Organizations that pass the audit receive a certification to demonstrate their compliance with the industry standards.

The security and integrity of customer payment card information are of utmost importance in today’s industry. A data breach can have severe consequences for both the affected customers and the organization responsible for the breach. Compliance auditing helps organizations proactively identify and address any security vulnerabilities that could lead to a breach.

By adhering to the PCI compliance standards, organizations can implement strong security measures, such as encryption, access controls, and monitoring systems, to protect sensitive cardholder data. Compliance auditing ensures that these measures are properly implemented and regularly validated, minimizing the risk of data breaches and ensuring the safety of customer information.

Overall, PCI compliance auditing plays a vital role in safeguarding payment card data. It helps organizations stay compliant with industry regulations, implement robust security measures, and detect and address any vulnerabilities that could compromise the security of customer data.

Identifying and Addressing Vulnerabilities through Auditing

Auditing plays a crucial role in ensuring data security and protecting against potential breaches. By conducting regular assessments and audits, organizations can identify vulnerabilities and address them proactively.

PCI compliance auditing is especially important in the payment industry, where sensitive data is processed and stored. Adhering to the regulations and standards set by the Payment Card Industry Data Security Standard (PCI DSS) is essential for businesses to protect customer payment data.

During the auditing process, a thorough examination of the organization’s technology, policies, and controls is conducted. This helps to identify any weaknesses or vulnerabilities that may exist within the system. The auditors assess whether the organization has implemented appropriate security measures and practices to safeguard data.

Identifying vulnerabilities through auditing allows organizations to take necessary corrective actions. It enables them to strengthen their security measures, update policies and controls, and implement necessary technology or system improvements. Regular audits also provide insights into emerging threats and risks within the industry, helping organizations to stay ahead of potential breaches.

Compliance with PCI DSS requirements and obtaining certification ensures that an organization is following industry best practices to protect sensitive data. It demonstrates to customers and partners that the organization is committed to maintaining a secure environment for payment transactions.

In conclusion, auditing is a vital process for identifying and addressing vulnerabilities in data security. By conducting regular assessments, organizations can proactively protect against potential breaches, comply with industry regulations, and maintain a secure payment environment.

Best Practices for PCI Compliance Auditing

PCI compliance auditing is crucial for organizations that handle payment card data, as it ensures the security of sensitive information and protects against data breaches. To maintain PCI compliance and adhere to industry standards, here are some best practices to follow:

- Perform regular security assessments: Conducting regular assessments and vulnerability scans of your network helps identify and address security weaknesses or potential risks.

- Implement strong access controls: Limiting access to payment card data to only authorized personnel through user authentication and password policies adds an extra layer of protection.

- Encrypt sensitive data: Encrypting payment card data both during transmission and storage can help prevent unauthorized access and protect against data breaches.

- Monitor and log all system activity: Keeping detailed logs of system activity allows you to track any potential security incidents and investigate them promptly.

- Establish and enforce security policies and procedures: Clearly define security policies and procedures and ensure that they are followed consistently across the organization.

- Regularly update and patch systems: Keeping all software and systems up to date with the latest security patches helps protect against known vulnerabilities.

- Conduct regular employee training: Educating employees on the importance of data security, PCI compliance, and best practices helps create a culture of security awareness.

- Engage a qualified third-party auditor: Hiring a certified PCI compliance auditor can provide an objective assessment of your organization’s security controls and help identify areas for improvement.

By following these best practices, organizations can maintain PCI compliance, protect payment card data, and reduce the risk of security breaches. It is important to stay updated on the evolving technology and industry standards to ensure ongoing compliance and data security.

Tips and Guidelines

When it comes to PCI compliance auditing, there are certain tips and guidelines that organizations need to follow in order to ensure data security and maintain their certification as a PCI compliant entity. These guidelines include:

- Implementing proper controls: It is necessary to implement and maintain a set of controls that are aligned with the requirements of the PCI DSS (Payment Card Industry Data Security Standard). These controls can include processes, technologies, and policies that help protect sensitive data and prevent unauthorized access.

- Regular assessment and auditing: Organizations should conduct regular assessments and audits to evaluate their compliance with the PCI DSS. This can involve internal audits as well as independent third-party audits, which help identify any potential vulnerabilities or non-compliance issues.

- Securing the network: It is crucial to secure the network infrastructure to protect against unauthorized access. This can be achieved through measures such as implementing firewalls, intrusion detection systems, and encryption technologies.

- Managing payment card data: Organizations should have proper policies and procedures in place to manage and protect payment card data. This includes securely storing and transmitting payment card information, as well as implementing measures to detect and respond to any potential breaches.

- Addressing vulnerability management: Regular vulnerability scanning and testing should be conducted to identify and address any weaknesses in the network or system. Vulnerability management processes should be implemented to ensure timely remediation of any identified vulnerabilities.

- Staying updated with technology and regulation: It is important to stay up to date with the latest technologies and regulatory requirements in the industry. This helps ensure that the organization’s security measures are in line with the evolving threats and standards.

By following these tips and guidelines, organizations can effectively protect their data, achieve PCI compliance, and reduce the risk of a data breach. Compliance auditing plays a crucial role in this process, as it helps identify any non-compliance issues and provides recommendations for improvement.

Ensuring Effective PCI Compliance Auditing

PCI compliance auditing is crucial in order to protect sensitive payment card data and ensure data security within the industry. The Payment Card Industry Data Security Standard (PCI DSS) sets forth guidelines and requirements for organizations to follow when handling payment card information.

Effective PCI compliance auditing involves a rigorous assessment of an organization’s controls, policies, and technology systems to ensure they are compliant with the PCI DSS regulations. This involves conducting regular audits to identify any potential vulnerabilities or weaknesses in the network or data security infrastructure.

The auditing process includes a thorough examination of the organization’s data storage, transmission, and processing systems. This includes reviewing network security measures, analyzing access controls, and assessing encryption technologies. It also involves reviewing policies and procedures related to data security and ensuring they align with PCI DSS requirements.

By conducting regular PCI compliance audits, organizations can identify and mitigate potential risks that could lead to a data breach. Auditing helps organizations identify any gaps in security controls and allows them to take corrective actions to improve their overall data security posture.

Successful PCI compliance auditing not only helps organizations achieve and maintain PCI certification, but it also demonstrates a commitment to protecting customer data and maintaining the highest level of data security. It is important for organizations to work with qualified auditors who have expertise in PCI compliance and can provide a thorough and objective assessment.

In conclusion, effective PCI compliance auditing is essential for organizations in the payment card industry to ensure data security and minimize the risk of a data breach. By adhering to the PCI DSS guidelines and conducting regular audits, organizations can proactively protect sensitive payment card data and maintain compliance with industry regulations.

Implementing Best Practices for Data Security

Payment Card Industry (PCI) compliance auditing is a crucial process for organizations that handle payment card data. Implementing best practices for data security is essential to protect against potential breaches and ensure compliance with industry regulations.

A comprehensive risk assessment is the first step in implementing best practices for data security. This involves identifying potential vulnerabilities in the network infrastructure and identifying areas that require improvement. By conducting regular audits, organizations can stay on top of security risks and proactively address any issues that may arise.

Having a strong data security policy is another vital aspect of ensuring compliance and protecting sensitive information. This policy should outline clear guidelines for data handling, encryption, access control, and incident response procedures. Regular employee training and awareness programs should also be implemented to ensure that all staff members are educated on the importance of data security and their role in maintaining compliance.

Deploying robust security technologies is key to protecting data from unauthorized access. This includes implementing firewalls, intrusion detection systems, and file integrity monitoring solutions. Encryption technologies should also be employed to protect cardholder data both in transit and at rest.

Regularly monitoring and testing the network and systems for vulnerabilities is critical to maintaining data security. Conducting penetration testing and vulnerability assessments can uncover any weaknesses in the system that could be exploited by hackers. By addressing these vulnerabilities, organizations can effectively protect against potential data breaches.

Seeking third-party certification for PCI compliance is highly recommended. This certification provides an extra layer of assurance that an organization’s data security practices align with industry standards. By undergoing a rigorous audit, organizations can demonstrate their commitment to data security and compliance.

In conclusion, implementing best practices for data security is essential in today’s digital landscape. By following industry regulations, conducting regular audits, and implementing robust security measures, organizations can protect against data breaches, mitigate risks, and ensure compliance with PCI standards.

FAQ about topic “Understanding PCI Compliance Auditing for Securing Data”

What is PCI compliance auditing?

PCI compliance auditing is a process of assessing and verifying an organization’s adherence to the Payment Card Industry Data Security Standard (PCI DSS). It involves conducting regular audits and reviews of an organization’s information security policies, procedures, systems, and controls to ensure they meet the requirements for protecting cardholder data. The purpose of PCI compliance auditing is to identify any security vulnerabilities and ensure that appropriate measures are in place to mitigate risks and maintain the confidentiality, integrity, and availability of cardholder data.

Why is PCI compliance auditing important for data security?

PCI compliance auditing is important for data security because it helps organizations identify and address potential security vulnerabilities that could lead to the unauthorized access, use, or disclosure of cardholder data. By conducting regular audits, organizations can ensure that they have implemented proper security measures and controls to protect sensitive cardholder information from data breaches and fraud. PCI compliance auditing also helps organizations maintain customer trust and confidence by demonstrating their commitment to data security and compliance with industry standards.

What are the consequences of non-compliance with PCI DSS?

Non-compliance with PCI DSS can have serious consequences for organizations. If an organization fails to comply with the security requirements outlined in the standard, they may be subject to fines and penalties imposed by card brands and acquiring banks. In addition, non-compliance can result in reputational damage, loss of customer trust, and potential legal action. It is important for organizations to understand and adhere to the PCI DSS requirements to avoid these potential consequences.

Who is responsible for PCI compliance auditing?

PCI compliance auditing is the responsibility of the organization that stores, processes, or transmits cardholder data. This includes merchants, service providers, and any other entities that handle payment card transactions. Organizations are required to conduct regular audits and assessments of their information security practices to ensure compliance with the PCI DSS. They may also engage third-party auditors or assessors to perform independent audits and validations. Ultimately, the organization is responsible for maintaining the security of cardholder data and ensuring compliance with the PCI DSS.